Founded on 19 November 1996, Shenwan Hongyuan Asset Management (Asia) Limited (“SWAM”) is a wholly-owned subsidiary of Shenwan Hongyuan (H.K.) Limited (Stock code 218.HK).

At present, SWAM is licensed by the SFC for Type 4 and Type 9 regulated activities.

Relying on both external support from the professional research team of our parent company (Shenwan Hongyuan Group) and internal support from our experienced asset management team, SWAM is striving to become one of the leading asset management companies in Hong Kong. We provide a full range of investment services, aiming to help our customers to achieve their investment goals and optimal returns.

Company Highlights:

- Cross-border Business Qualifications: QFII A-share investment scheme was launched in 2005; QDII qualification was obtained in 2011; RQFII qualification was obtained in 2012.

- Professional Investment Team: All members of the investment team graduated from top universities around the world. Our investment team is familiar with capital markets in both mainland China and Hong Kong SAR, and has a good understanding of the macroeconomic strategies of mainland China and Hong Kong SAR. We have diversified investment experiences and conduct in-depth research on industries such as consumer goods, automation, high-tech and industrial manufacturing, as well as macro economy. At the same time, we are good at both offshore Asian US dollar bond and onshore RMB bond investments.

- High Quality Service Providers: SWAM accumulates extensive experiences in investment and risk management. We establish strong long-term relationships with international banks, law firms and audit firms.

- Well-connected Network and Client Base: Our parent company, Shenwan Hongyuan Group has nearly 8,000 employees, 34 branches and 303 brokerage offices in mainland China. It also has offices located in Hong Kong, Singapore, Tokyo, Seoul and London.

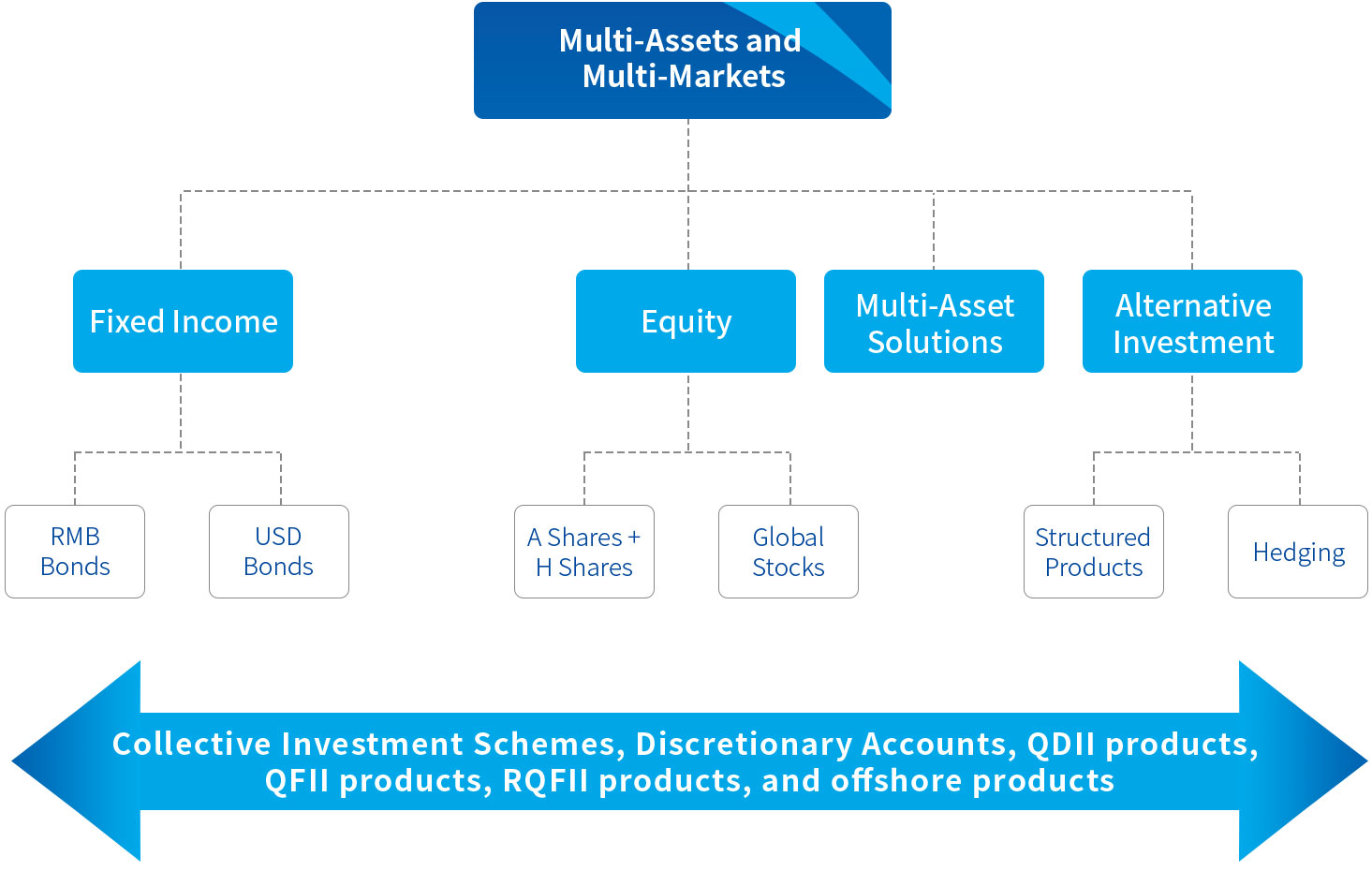

Shenwan Hongyuan Asset Management (Asia) Limited has teams specialized in managing Collective Investment Schemes, Discretionary Accounts, Qualified Foreign Institutional Investor (QFII) products, RMB Qualified Foreign Institutional Investor (RQFII) products, and offshore products. By asset class, our product lines include equity, fixed income, multi-asset solutions and alternative investments.

Types of Investment

- Traditional Secondary Market: Stocks, Bonds or Hybrid

- Alternative Investment: Structured Products and Hedging

- Derivatives: Foreign Exchange Hedging and Market Risk Hedging

Channels of Investment

- Public Funds

- Collective Investment Scheme or Discretionary Accounts