-

Can I open an account without visiting branch in person?

Since our licensed Account Executives must be witnessing the whole application process; therefore, you can only make application by visiting our branches in person. If you are unable to visit our branches within office hour, please contact customer service hotline (852) 2250 8298 for any special arrangement.

-

If I am not a Hong Kong resident, can I open account in SWHY?

Yes, we welcome non Hong Kong residents to use our services. Please contact our customer hotline (852) 2250 8298 for more information.

**We do not accept new account opening applications from individual clients from mainland China excluding clients who live/work overseas. -

Do I need to pay any application fees? Is there any initial deposit requirement?

We do not have any charges or initial deposit requirement on new account application.

-

Can I open a joint name account in SWHY?

Yes, we accept joint name account application. Either one of the account holders can place buy or sell order, the withdraw instruction; however, must be signed by all members.

-

Which kind of document is requested on my account application?

If you are a client from Mainland China, please provide your ID card, valid passport and address proof (issued within latest 3 months); otherwise, please provide your HKID or valid passport and address proof (issued within latest 3 months).

-

What are the procedures to open account?

i) Complete the application forms and cross out inapplicable parts with our licensed Account Executive signing as witness.

ii) Read the declaration, terms and conditions carefully, and if you have any question, please ask our staff for more detail.

iii) Provide requested documents. For more detail please refer to FAQ question 6. -

Can I have both Cash and Margin accounts on the same time?

Yes, please contact your Account Executive or Customer Hotline (852) 2250 8298 for detail.

-

Which part should I pay extra attention on my application?

In order to protect the interest of our clients, we will not process any instructions if the signature cannot be verified, so we suggest clients remember his/her specimen signature.

-

How long does it take to open account?

Generally speaking, it takes 2-3 working days to process after we have received your valid application with all requested documents. You will receive our confirmation letter after related procedures are completed.

-

What kind of activities can the authorized person perform to the account if he/she is appointed by the account holder as the account’s authorized person? (applicable to individual account/joint account only)

The authorized person can make the following instructions for the account:

(a) Securities (including stock options) trading;

(b) fund withdrawal to the registered bank account;

(c) currency exchange in the securities, futures and stock options account; and

(d) fund or stock transfer between Shenwan Hongyuan securities, futures and stock options accounts

-

How to apply for online trading service?

If you are a new customer, then please mention to our staff before application; otherwise, please contact your Account Executive or visit our branches for application.

-

Do I need to pay any application fees on online trading service?

There is no additional charge on online trading application.

-

Can I enjoy any free real time quotation services?

Our online trading clients can enjoy 250 times free snapshot Quotation service, and clients also can receive an extra 100 times snapshots for each successful trade via online system. Apart from snapshots quotation service, we also provide streaming real time quotation services (monthly fees applied, please refer to “Real Time Quotation Service” section for detail).

-

What kind of information can I get from the streaming real time quotation service?

Information on real time quotation services include: financial news, research and analysis reports, real time stock price quotation, Hang Seng Index, technical charts and company profitability. Please refer to “Real Time Quotation Service” session for more detail.

-

How long does it take for my online trading account application?

It normally takes 2-3 working days after we have received your completed application. The confirmation letter and password will be sent by email and mail separately.

-

If I received the confirmation letter for a period of time, but I haven’t received my password yet, then what should I do?

To protect your account not being used by unauthorized person, please contact our customer service hotline (852) 2250 8298 a.s.a.p

-

I have received both password and confirmation letter, then what I should do?

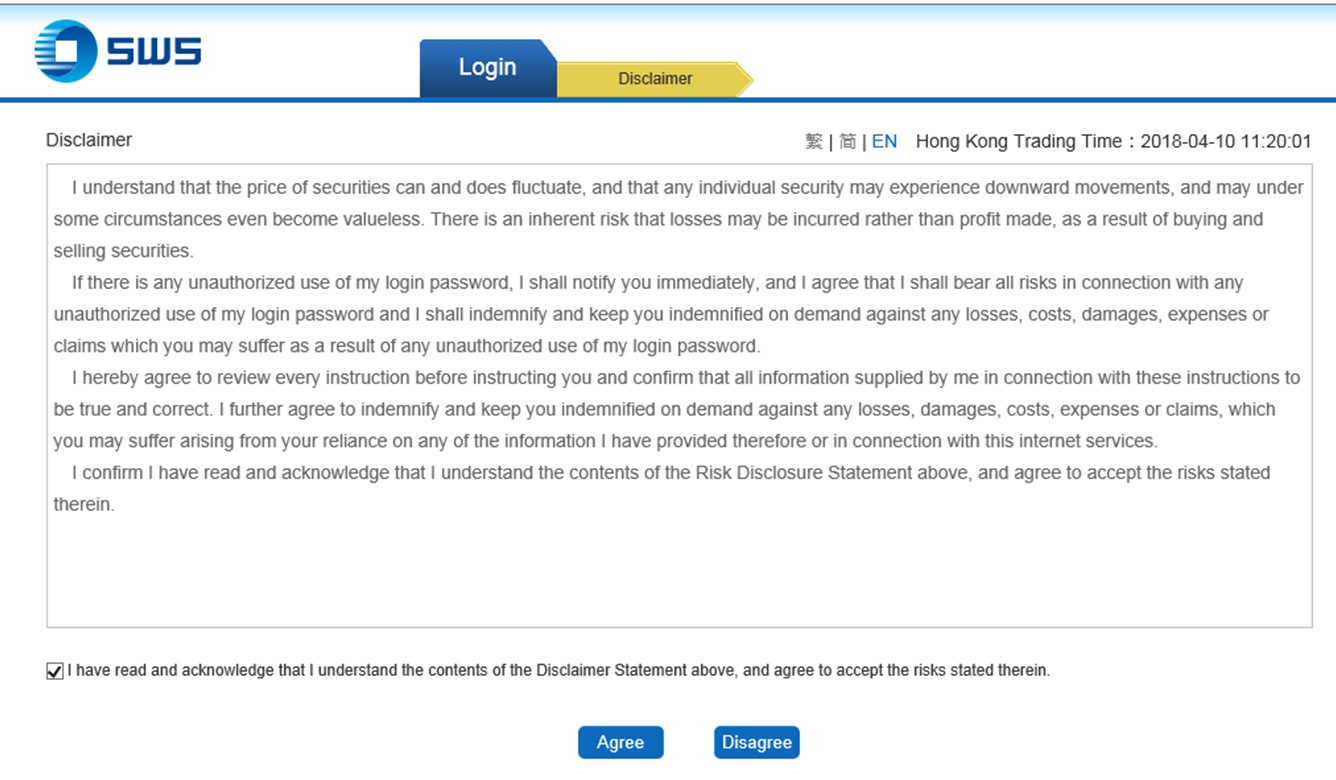

If you have received both password and confirmation letter, then you can start to operate your online trading account via our consolidated e-Service. Please follow the instruction and procedure to login your account (Login name is listed on the confirmation letter). We recommend changing your personal password on the first time login.

-

If I forgot my login password, then what should I do?

If you forgot your password, then please download and fill in the “Online Trading Facilities – Password Re-Issuance Request Form” from our website.

-

What is IPO?

IPO, Initial Public Offer, is the first sale of shares or bonds by a company for raising funds from public investors.

-

How many channels are there to apply IPO?

Physical white application form [in name of beneficial investor(s)] with zero financing

Physical yellow application form [in name of beneficial investor(s)] with zero financing

Physical yellow application form [in name of nominee] with zero financing or with non-zero financing

CCASS eIPO application instruction with zero financing or with non-zero financing [in name of nominee] -

How to subscribe IPOs?

Please view more details: Online IPO Subscription

-

What is IPO Financing? What is the risk?

IPO Financing is a short term loan facility. We may lend to our cash or margin client up to 90% of the value of shares subscribed. Clients financing their applications through IPO financing are exposed to additional risks*.Clients should ensure full understanding of the risks before commiting to the IPO loan.

Notes:

* Stock price of the issuer will be fluctuate according to market situations after listing and may be substantially below the IPO offer price. on. Besides, you may be allotted shares more than what you expect. The liquidation proceeds of the allotted shares may not be sufficient for repaying the outstanding IPO loan in full. -

Why may I need IPO Financing?

With the IPO loan, you could apply for more IPO shares. Please note that the actual quantity of shares allotted to you depends on factors including but not limited to the subscription ratio and the method of allotment as determined by the issuer.

-

Does SWHY provide Financing on all IPOs?

We only offer Financing on selected IPOs listed on HKEx Main Board or GEM Board. Please contact your Account Executive/Customer Service Hotline (852) 2250 8298 or login our Consolidated e-service for more information.

-

What is the benefit of applying through our nominee services?

Simple and Convenient: Few simple steps for application

Increase application capability: With IPO loan, can subscribe shares up to ten times (maximum) of your available funds to increase application capability

Information advantage: Will receive information about application status and allotment result via email and SMS

Enhanced settlement efficiency: As the allotted shares and refunded cash will be deposited to your securities account, you can buy or sell on the IPO on the first listing day. -

When should I place my order to apply for IPO Financing/Nominee services?

In general, the cut off time is on 2:00 p.m. (IPO Financing Application) and 4:00 p.m. (Nominee Application) of the second last day of the application period. If you want to apply for IPO loan, we would suggest you place your order as early as possible as the availability of the IPO loan is subject to our financial resources.

-

When should I deposit the subscription amount?

If you have applied for IPO using Financing or Nominees Services, please deposit sufficient funds in your trading account before our application cut off time. And application payment will be put on hold after cut off.

If you apply by White Form or Yellow Form in your own name, then please drop your application and payment into bank collection boxes before application list closes. -

How can I check the allotment result?

White Form & Yellow form - Please check the result on newspapers or HKEx website.

Margin Financing & Nominees - You will receive our allotment result confirmation via email and SMS. Also you can check the allotment result with account executive or our hotline (852) 2250 8298. Allotted shares will be directly lodged in your SWHY trading account. -

How the unsuccessful application wil be refunded?

On refund cheque dispatch date, amount refunded to clients using Margin Financing or Nominees Services will be directly credited to their SWHY accounts. For applications in own name of the applicant, refund cheque will be directly mailed to the applicant’s address as specified on the White Form/Yellow Form.

-

Can I sell my allotted shares on the first dealing day?

If you are applying through Yellow Form, IPO Financing or Nominee Services, allotted shares will be directly deposited into your SWHY account on the business day before the first dealing day. Therefore, you can start trading the allotted shares after listing. And White Form applicants need to wait until physical shares are received via mail.

-

What is “Clawback”?

“Clawback” is a mechanism for the issuer to reallocate the issued shares between the Public Offer Tranche and the Placing Tranche depending on the subscription demand in each of the Tranches.

-

What does “Allocation of Public Offering Shares – Pools A and B” means?

Sponsors normally separate Public Offering applicants as two divisions, Pool A and B, whom subscribes the IPO above $5 million HKD is under Pool B; otherwise, is Pool A. If either division is under-subscribed, then Sponsors will transfer the surplus to another Pool. Once there is over-subscription, Pool A and Pool B allotment ratio will be depended on successful applications within each Pool.

-

When is the settlement date in Hong Kong market?

According to HKEx rules, all trades must be settled on T+2 (within 2 trading days).

-

Can I sell some physical stock which I am holding before I lodge those stocks in my securities account?

Yes, you can sell your physical stocks first and lodge those stocks to CCASS via us on the next business day after trading. According HKEx rules, you must ensure that you have enough settlement stocks. Otherwise, you will be obligated to bear the extra costs to buy-in stocks by any failure. Unlike normal trading, physical stock takes 13 working days to complete the entire process. You can only use those non-withdrawal credits on trading within the processing period.

-

How can I transfer my stocks from another securities dealer/bank to SWHY?

If you want to transfer stocks between brokers, then please fill in our “SI instruction form” and place SI instructions to both companies.

-

How to deposit funds in my SWHY account?

You can make deposit via Bank of China (HK) Ltd, HSBC (HK) Ltd, PPS, Standard Chartered Bank (HK) Ltd to your SWHY account. For more detail please refer to “Fund Deposit & Withdrawal” section.

-

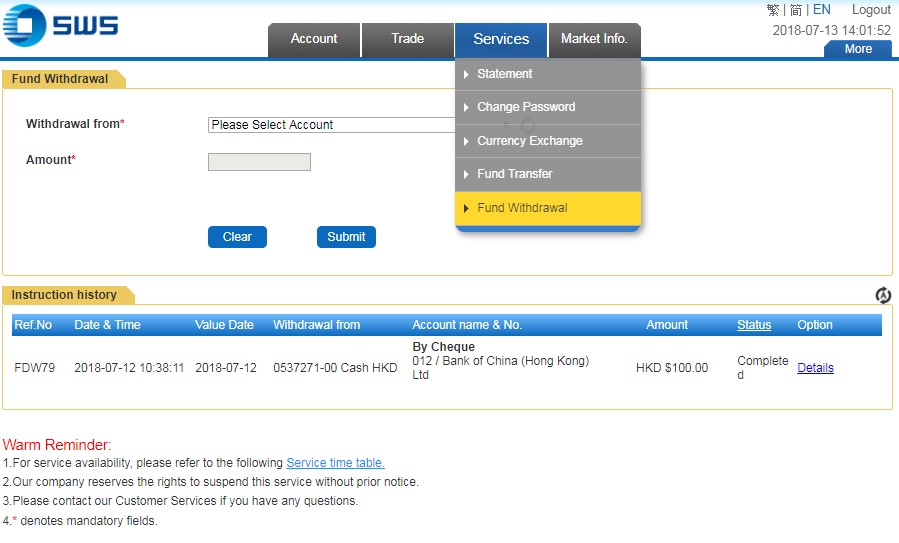

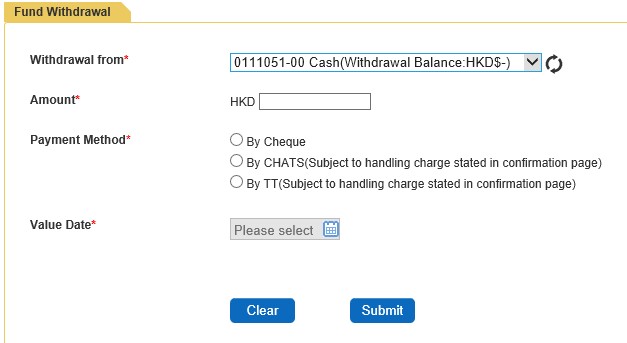

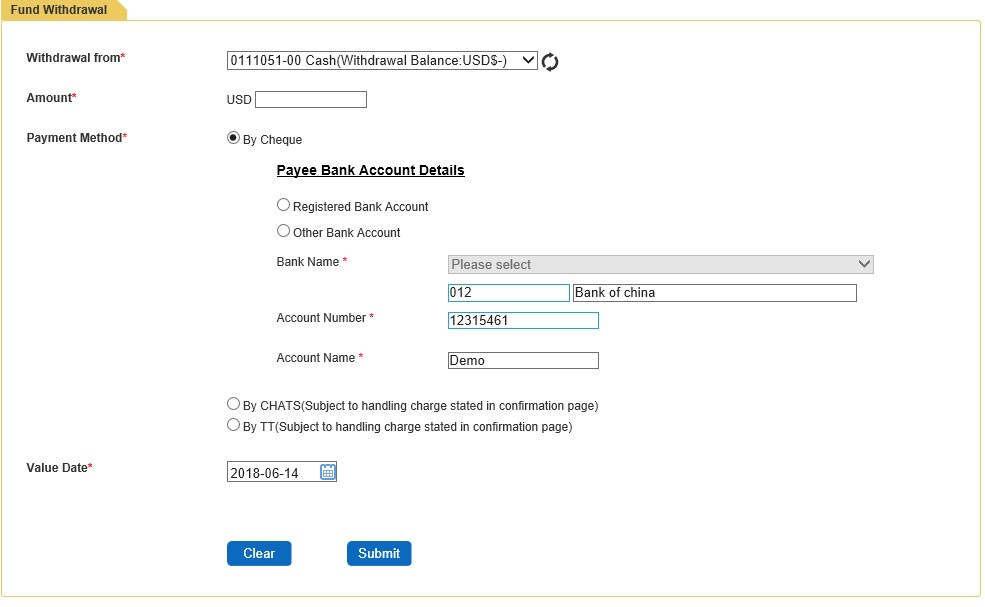

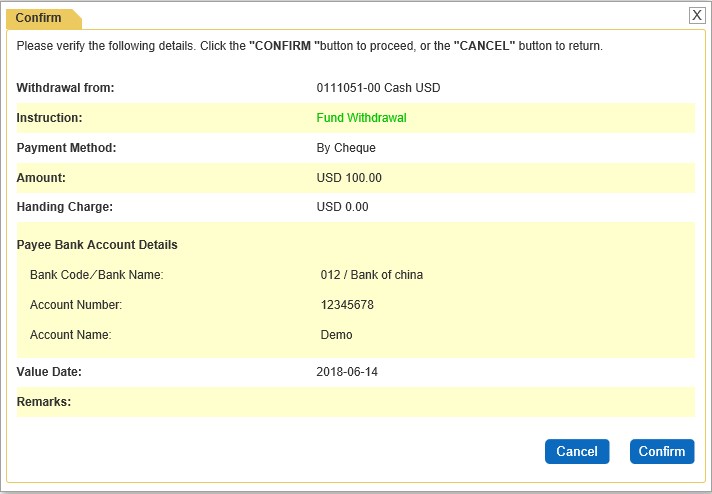

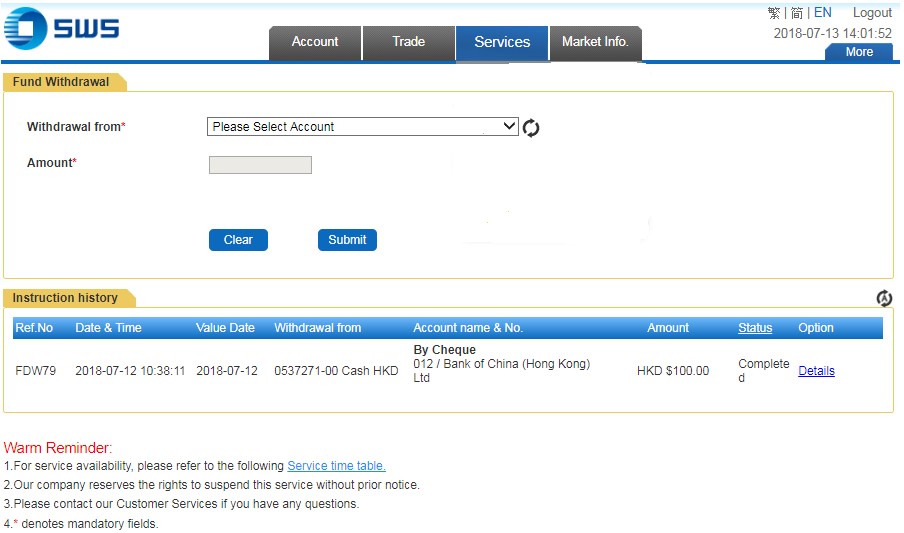

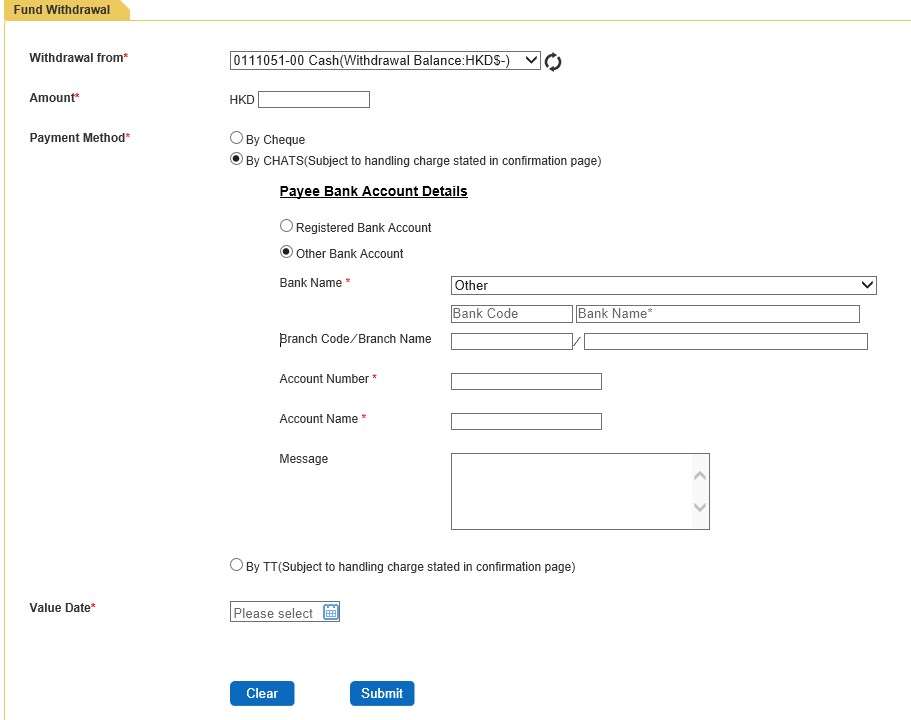

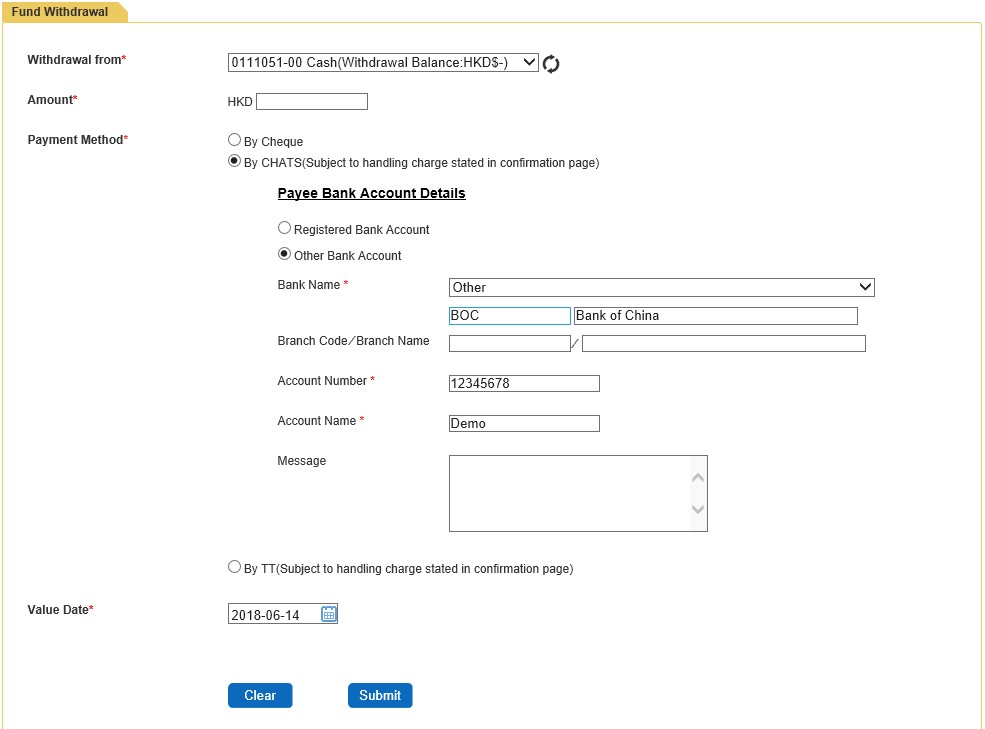

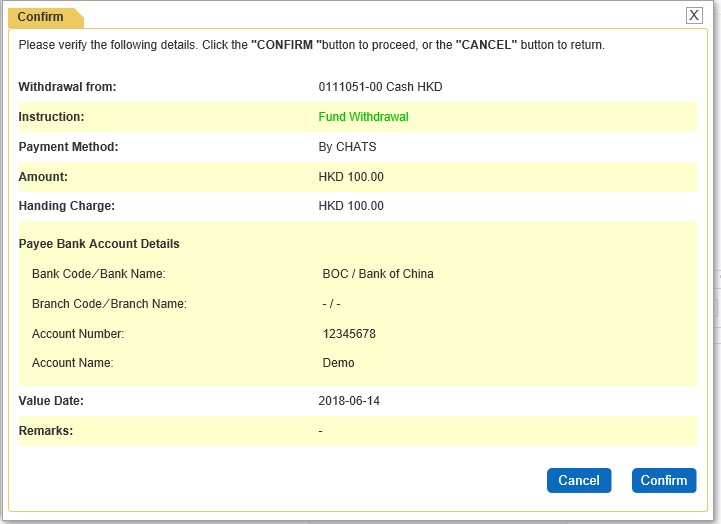

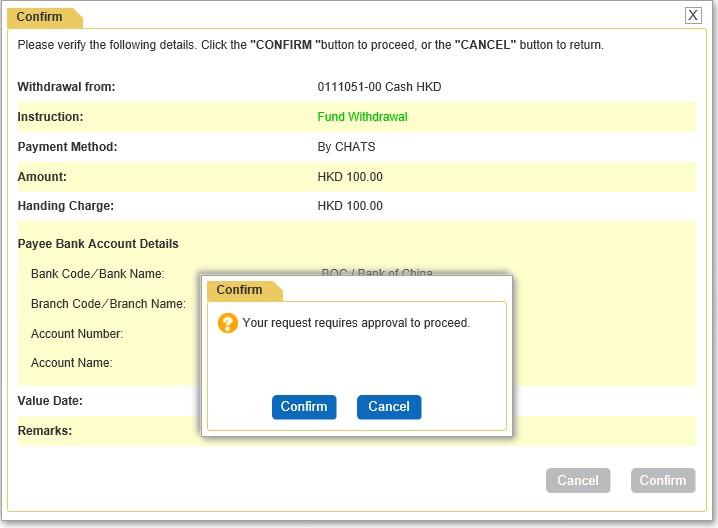

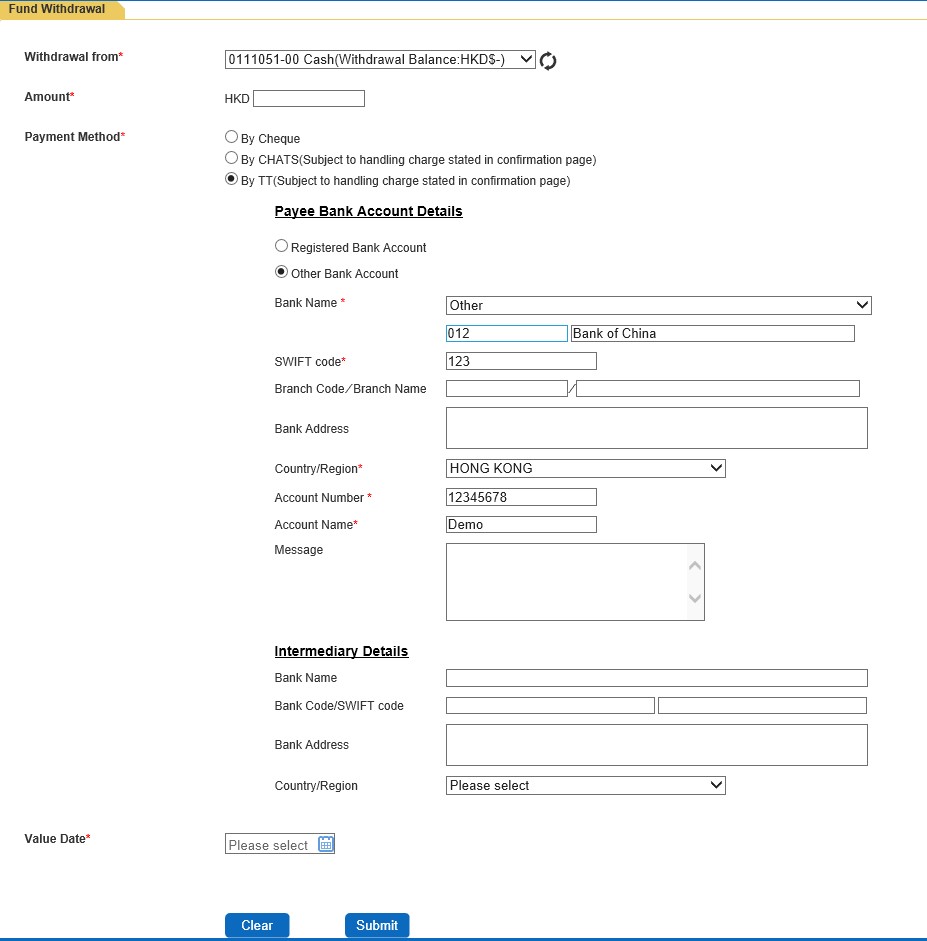

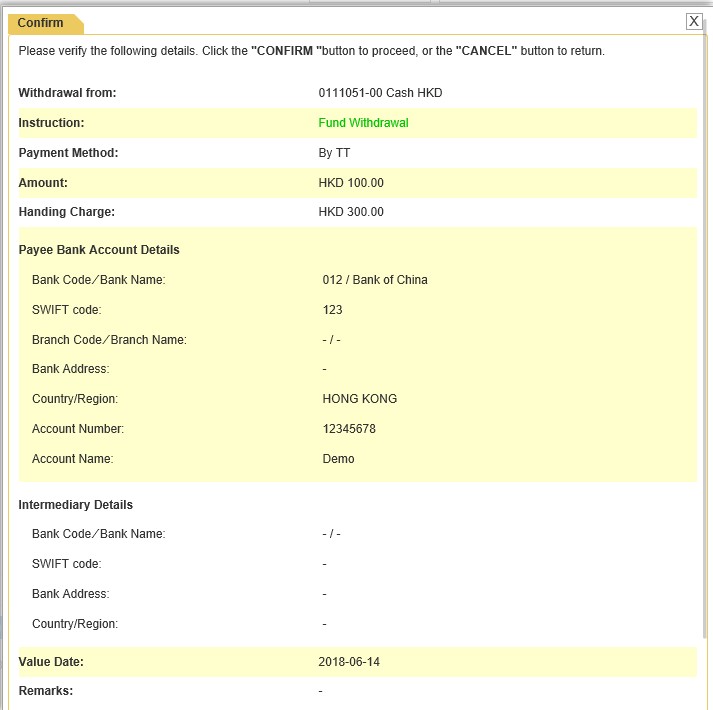

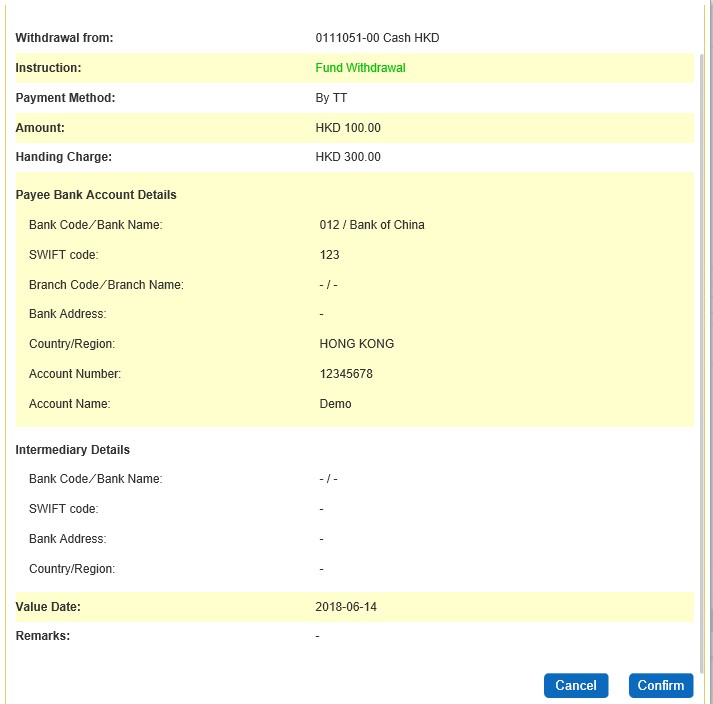

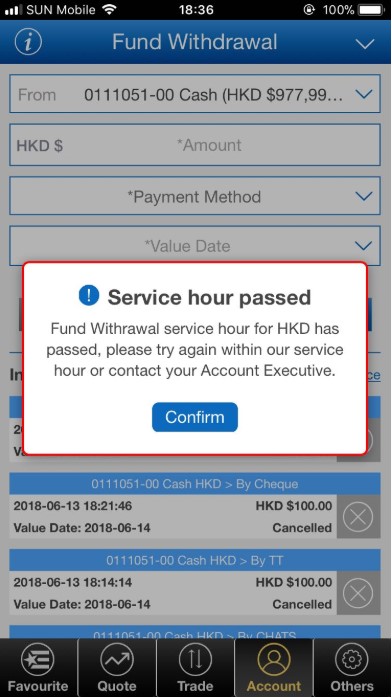

How to withdraw funds from my account?

If you have already registered a bank account with us, then you can either contact AE or fill in Cash Withdrawal form for instruction. Otherwise, please fill the Cash Withdrawal form for instruction.

-

If I want to change my settlement bank account, what I should do?

Please download and fill in Change of Client Data form to update your settlement bank details.

-

Can I register more than one settlement bank account?

Yes, you can register more than one settlement bank account with us.

-

If I have a joint name account in SWHY, then can I transfer funds into my single name bank account?

In general, we will only transfer funds to bank accounts as the exact name with our record. If you have any special request, then please contact Account Executive for arrangement.

-

What is the meaning of “third party payment”?

In general, we can only transfer withdrawal to the exact name account on our record; otherwise, it is “third party payment”. If you need to arrange a “third party payment”, then please contact your Account Executive for more information.

-

When will I receive my daily and monthly statement?

You will receive a daily statement after any cash or stock movement within your account. Also if your account is not inactive (nil balance and no transaction within the month), then you will receive a monthly statement within first 7 working days on the next month. We suggest clients read the statement carefully. If there is any difference with your own record, please contact us a.s.a.p.

-

What methods are there available to receive statements?

Our daily and monthly statements can be issued to you by post or by e-mail (i.e. our e-statement service). You can choose either one of the ways by giving us your written instruction. You can also access consolidated e-Service to retrieve or download the daily and monthly statements.

-

Can I request not to receive any statement?

According to SFC regulations, we must issue statement to clients for all transactions of their account. Even there is no transaction within the month, but we must issue statement if account balance is not nil.

-

What is the benefit of using e-statement? How can I change to receive e-statement?

Unlike using postal statement, e-statement has more flexibility and shorter delivery period for you to check your account status. If you want to receive e-statement, then please fill our Change of Client Data Form to change the mode of posting.

-

Do I need any special set up on my computer for receiving e-statement?

The Acrobat Reader is pre-requisite to open the e-statement file, and also please frequently manage your mailbox to have available space for receiving e-statements.

-

What is Margin Financing? How does it work?

Margin Financing is a revolving credit facility on margin account. Clients can collateralize their stock holdings for additional buying power, and the collateral ratio is depended on own portfolio valuation. Stocks comprising Hang Seng Index have the highest margin ratio (approx 50% to 70%).

-

What is the difference between Cash account and Margin account?

Unlike Margin account, cash account clients do not have financing facility, so they must deposit sufficient funds before trading. Also Margin account clients can enjoy lower interest charges on outstanding balance.

-

Where can I have the information about my margin account credit limit, terms and conditions and interest rate?

You will receive a confirmation letter and a Margin Financing Facility Letter after application progress completed. The Facility letter will list all detail information, including credit limit, terms and conditions and interest rate. And please sign the copy of the facility letter and return to us.

-

Can I do not sign and return the copy of Margin Financing Facility Letter?

We are pleased for you to return the signed Facility Letter. However, even not returning the signed letter, you are assumed acceptance with all terms and conditions on the facility letter once the credit limit has been used. In additional, our credit department will frequently review and adjust your margin limit.

-

When will I need to pay interests?

Interest will be charged on your overdue negative balance after settlement date. For more information, please check with your facility letter.

-

What is margin call?

Since the collateral stocks value are floating with the market price. Once the margin value level is below the account outstanding, then you will be requested to deposit additional cash or collateral stocks to settle the difference.

-

What will happen if I do not deposit additional cash or collateral after margin call?

If you do not deposit additional cash or collateral within the requested period, then we may liquidate your collateral to cover the margin deficit.

-

How can I place order to my account?

If you are our online trading client, you can place the order either via internet or your Account Executive; otherwise, you can only place your buying or selling order with your Account Executive.

-

Can I make deposit on the settlement date?

We accept clients deposit fund not later than the settlement date, T+2, 2 days after the trading date; however, we recommend our clients deposit sufficient funds before trade to avoid charges on unexpected delay. For more detail, please refer to the section “Fund Deposit & Withdrawal”.

-

What is “day trade”? How does it operate?

If you buy and sell the same stock within the same trading day, it is called “day trade”. You can sell stocks anytime after the “buy-in” order has been executed. Please check the transaction status via account executive or online trading system.

-

If I want to sell some physical stocks on hand, what should I do?

In order to trade effectively and efficiently, we suggest you lodge those physical stocks in the securities account before you trade. Otherwise, you can place the order with Account Executive first, and lodging in stocks within the next trading day after the order has been executed.

-

Where can I get more information about securities quotation, profile and market flow?

Our Account Executives are glad to provide stock quotations and reliable market news to clients. And you can also read the daily analyses and research reports from Shenwan Hongyuan Research (H.K) Limited

-

Can I require any particular quantity on trading?

According to HKEx standards, listed stocks must be traded under “lot” as a multiplier; therefore, clients cannot have any special request on the quantity.

-

What is Ex-Dividend Date? How does the stock price be affected?

In general, ex-dividend date is 2 trading days before the record date (record date will be announced when dividend is declared). Since the dividend will credit as payable on ex-dividend date morning, it will cause a difference between opening price on ex-dividend date and closing price on the day before.

-

What is Warrant?

Warrant, a securities option, gives the right (not obligation) for clients to buy or sell shares on specific value and date. Warrant’s value relies on the share price but required capital is much less than ordinary stocks; therefore, clients will have extra profit or loss by this leverage effect. Apart from leverage risks, clients may face higher risk on warrant investment than investing in ordinary stocks by the reason of limitations on exercise value and date.

For example, if you bought HSBC warrant for $2 (exercise price $130 and expired on Dec 31, 2005). You can gain the premium if and only if the price on Dec 31, 2005 is above $132; otherwise, your warrant will become worthless. -

How many types of warrants are there in the market?

Equity warrant: Issued by listed companies

Derivative warrant: Issued by sizable banks and brokerage firms

Call warrant: Price goes up when the underlying stock price is up

Put warrant : Price goes up when the underlying stock price is down

Also there are many other kinds of warrants in the market, please contact your Account Executive for more information. -

What is the difference between European style and American style warrant?

American style: warrant can be exercised on anytime before expiry.

European style: warrant can only be exercised on expiry date. -

What is the difference between Main Board and GEM (Growth Enterprise Market)?

The Main Board and the Growth Enterprise Market are two trading platforms of the HKEx securities market.

Main Board is a market for capital formation by established companies with a profitable operating track record or companies meeting alternative financial standards to profit requirement. Growth Enterprise Market is an alternative market established in November 1999 to provide capital formation opportunities for growth companies from all industries and of all sizes. For more information, please browser HKEx websites. -

How can I identify stocks listed on GEM?

You can identify GME stocks by stock code 8000 to 8999.

-

What are the trading hours for Hong Kong market?

Trading Hour for HKEx: (except public holiday):

Normal Day Trading Half- Day Trading Pre-opening Session 9:00am to 9:30am 9:00am to 9:30am Continuous Trading Hours 9:30am to 12:00pm 9:30am to 12:00pm 1:00pm to 4:00pm Closing Auction Session Afternoon Session 4:00pm to 4:10pm 12:00pm to 12:10pm Notes: Half day trading on Christmas Eve, New Year Eve and Chinese New Year Eve.

-

When is the Settlement Date?

Settlement Date is 2 trading days after Transaction Date (T+2).

-

What are the charges for trading?

Trading Charges include: Brokerage, Stamp Duty, Transaction Levy, Trade Fee and CCASS Fee. For more detail please refer to our Fees and Charges table.

-

What is the different between B shares, A shares and H shares?

All three types of shares are from enterprises that are listed on Shanghai or Shenzhen Exchange market.

B Shares: Open for foreign investor and investor within P.R.C. & Settled by foreign currency only.

A Shares: Common shares which only open for local residents (except investors from Hong Kong, Macao and Taiwan) & Settled by RMB only.

H Shares: Also listed in HKEx & It is called a Red Chip company if most of the company shares hold by groups related to P.R.C.

-

What is ST share?

ST (Special Treatment) shares are enterprises listed in Shanghai or Shenzhen Exchange market, that have recorded losses for the past 2 continuous financial years. And those enterprises may be delisted if they are still in deficits in the coming year.

-

What is investor code?

Investor Code, an unique password, organized by Shanghai and Shenzhen Exchange House, is used to identify investors (Shanghai and Shenzhen investor code are different). Investor is reminded to provide the code on each time placing orders.

-

Can I apply an Investor Code via SWHY if I do not have one? Do I need to pay any fees on the application?

Yes, you can apply an Investor Code via us (handling fee applied, please refer to Charges and Fees session for detail), and we will automatically become your custodian on B shares trading. We will forward the Clearing House confirmation to you after the application completed. Your name, investor code and clearing member code (custodian) will be listed on the confirmation.

-

If I already have my own investor code and want to invest B shares via SWHY, then what I should do?

Please provide a copy of your Clearing Houses investor code confirmation during the account application. You are not allowed to trade until your investor code is certified and linked to your account, and also if you want to change SWHY as your custodian, then please update your custodian record.

Shanghai Market

According to Shanghai Exchange House regulations, you can only have one custodian, but you are not restricted to place order with other brokers.

Since our settlement period is different with Clearing Houses, if you have placed a buying order via us, then we will debit your funds on T+2 and stocks will lodge in your account on T+3.Shenzhen Market

Unlike Shanghai Market, you can have more than one custodian. When you place an order with a broker, that broker will automatically become your custodian on that transaction. However, you can only place selling order when sufficient shares have been transferred and held within your dealing account. Since our settlement period is different with Clearing Houses, if you have placed a buying order via us, then we will debit your funds on T+2 and stocks will lodge in your account on T+3.Note: Referring to the China Securities Regulatory Commission regulation (effective on Feb 21, 2001), all P.R.C. residents investor codes only can place order with certain local dealers.

-

Can I directly transfer stocks between Clearing Accounts?

Direct transferring is prohibited by China Securities Regulatory Commission regulations, so you can only transfer stocks with parallel trading on market price (Charges and Fees are applied as normal trading).

-

If I haven’t received any statement since I got my investor code, then what should I do?

We suggest you contact the custodian for enquiry. In general, if you have not changed your custodian, then your first B shares account broker is your custodian. If you still cannot clarify with your custodian, then you can enquire with Shanghai and Shenzhen Clearing Houses in person, or we can assist to check the custodian details upon your request, but charges and fees will be applied (Shanghai: $15 USD per enquiry, Shenzhen: $100 HKD per enquiry).

-

Can I have “day trade” on B shares?

Shanghai and Shenzhen stocks markets do not allowed “day trade” since Dec 2001, so your account must have sufficient funds for settlement on T+2 (interest will be charged on negative balance after T+2).

-

Can I have more than one investor code in same Clearing House?

Unfortunately, you can only have one investor code in each Clearing House.

-

Where can I get more information on B shares?

Please browse webs: www.sywg2000.com.cn or www.sw108.com.cn

-

How many channels can I place order to trade US securities with SWHY?

You can place your order by contacting your account executive/ dealing room and online trading. Please contact customer hotline for detail.

-

Which stock exchange market I can trade in SWHY?

You can trade all securities and warrants within NYSE, NASDAQ, AMEX, ARCA and OTC markets.

-

Can I place my order before US market open?

Yes, you can place your order at an hour before market opens. We will place your order after market opens. Also you can place your US securities order via our 24 hours dealing hotline (852) 2841 6388.

-

Can I trade US securities on Hong Kong public holiday?

You can still trade US securities if it is not a US public holiday.

-

Does SWHY provide the US securities quotation service?

We provide the online delayed quotation or contact our dealing hotline (852) 2841 6388 for real time quotation.

-

How many types of order can I choose on the online service?

Our online service provides the limit order.

-

Is there any time restrictions for the order?

All the orders will be held on the system within the trading day only.

-

When is the settlement date?

The settlement date is T+3.

Effective from September 5, 2017, the settlement date will be changed to T+2. -

How many shares are there for one lot?

US securities trading is not limited by the multiple of lot, you can place an order for at least one share.

-

Can I short sell the stock?

We do not provide short sale service.

-

Can I buy and sell the same stock within a business day?

Yes, US market accepts day trade.

-

If I do not have sufficient USD within the account, but I have other currencies, can I place my buying order on US securities?

Yes, our online system buying power includes your cash in other currencies and margin facility from your Hong Kong market holdings.

-

When will SWHY debit the USD from my account for the buying transaction?

We will debit the fund from the account on the settlement date. If the settlement date is Hong Kong public holiday, then we will debit the fund on the last business day before settlement date. Therefore, client must deposit sufficient fund before settlement date.

-

When can I sell the shares which I bought within the trading date? And when can I receive the fund for that transaction after my selling order complete?

You can sell the stocks any time after the "buy-in" order has been executed. Please check the transaction status via dealing hotline or online trading system. The captioned fund will be deposited to your account on the settlement date.

-

Can I request to withdraw or deposit physical scrip?

No, we do not provide the physical scrip withdrawal and deposit service.

-

How are the commission and fees being calculated if I trade the same stock for several times on the same day?

The commission and fees would be calculated on the basis of the number of executed orders.

Do I need to have sufficient relevant foreign currency for trading global futures product?

Yes. You must have sufficient relevant foreign currency for meeting the margin requirement of opening and maintaining the global futures product (i.e. non-HKFE futures product). Please note that each currency balance in the statement would split into HKFE ledger balance and non-HKFE ledger balance. If you open and maintain the HKFE futures position, you must have sufficient amount of relevant currency in the HKFE Ledger for meeting the margin requirement. If you open and maintain non-HKFE futures position (i.e. global futures product), you must have sufficient amount of the relevant currency in the non-HKFE ledger. If you do not have sufficient relevant currency for the open positions in the ledger, you have to deposit relevant currency or make the fund transfer/foreign exchange order before the cut-off time for fund deposit of the trading day. Otherwise, our company may execute the fund transfer/foreign exchange order in the ledger for replenishing the currency shortfall before the end of the trading day without prior notice.

-

What is Pre-Opening Session?

9:15-9:20 Pre-matching Session 9:20-9:28 Matching Session 9:28-9:30 Suspended Session -

Which type of orders can be placed during Pre-Opening Session?

9:00-9:20 At-auction Order (sell only)

9:00-9:15 Limit Order -

What is At-Auction Order?

At-auction Orders are not available for a buy order. At-auction orders are only available on pre-opening session (9:00-9:20am). Customers need to enter stock code and quantity only. An at-auction order enjoys a higher order matching priority than an at-auction limit order and will be matched in time priority at the final IEP. Any outstanding at-auction orders after the end of the Pre-opening Session will be cancelled before the commencement of the Continuous Trading Session.

At-auction Order is not applicable in Closing Auction Session. -

What is Indicative Equilibrium Price (IEP)?

Indicative Equilibrium Price is the price at which the maximum number of shares can be traded if matching occurs at the Pre-opening Matching Session.

Demonstration 1:

Pre-opening matching period

BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) 30.00 100 30.00 60 29.95 130 29.95 70 29.90 100 29.90 60 29.85 60 29.85 50 29.80 180 29.80 60 PRICE($) ACCUMULATED BUY ORDER(000) ACCUMULATED SELL ORDER(000) MATCH ORDER 30 100 300 100 29.95 230 240 230 29.90 330 170 170 29.85 390 110 110 29.80 570 60 60

Hence, $29.95 matched the most stocks in the above table. $29.95 will be considered as IEP.Demonstration 2:

For example, we need to sell 100,000 shares during the pre-market auction.

Pre-opening matching period

BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) AUCTION SELL 100 30.00 100 30.00 60 29.95 130 29.95 70 29.90 100 29.90 60 29.85 60 29.85 50 29.80 180 29.80 60 PRICE($) ACCUMULATED BUY ORDER(000) ACCUMULATED SELL ORDER(000) MATCH ORDER 30 100 400 100 29.95 230 340 230 29.90 330 270 270 29.85 390 210 210 29.80 570 160 160

Hence, $29.90 can match the most quantity, $29.90 will be considered as IEPDemonstration 3:

For example, we wish to buy 50,000 shares during the pre-market auction session**

Pre-opening matching period

BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) ACCUMULATED BUY ORDER 50 AUCTION SELL ORDER 100 30.00 100 30.00 60 29.95 130 29.95 70 29.90 100 29.90 60 29.85 60 29.85 50 29.80 180 29.80 60 PRICE($) ACCUMULATED BUY ORDER(000) ACCUMULATED SELL ORDER(000) MATCH ORDER 30 100 400 150 29.95 280 340 280 29.90 380 270 270 29.85 440 210 210 29.80 620 160 160

Hence, $29.95 can match the most quantity, $29.95 will be considered as IEP. -

What are the order types permitted during continuous trading session (9:30am – 4:00pm)?

(i) Limit

(ii) Special Limit -

What is a Limit Order?

- Clients can enter stock code, trading quantity and price during the Pre-opening session (Pre-opening Session: 9:00-9:30 am).

Clients are not permitted to input new order on Closing Auction Session, but are allowed to amend and cancel order at “Reference Price Fixing Period” and “Order Input Period”. Clients are not permitted to input/change/cancel order at “No Cancellation Period”. - Limit order with a specified price at or more competitive than the final IEP (in case of buying, the specified price is equal to or higher than the final IEP, or in case of selling, the specified price is equal to or lower than the final IEP) may be matched at the final IEP subject to availability of eligible matching order on the opposite side. Any outstanding at-auction limit orders at the end of the Pre-opening Session will be carried forward to the Continuous Trading Session.

- During normal session (09:30am – 12:00pm), Limit order allows matching of up to 5 price queues (i.e. the best price queue and up to the 5th queue at 4 spreads away) at a time provided that the traded price is not worse than the input price. The sell order input price cannot be made at a price of 5 spreads (or more) below the current bid price whereas the buy order input price cannot be made at a price of 5 spreads (or more) above the current ask price.

- Any outstanding enhanced limit order will be treated as a limit order and put in the price queue of the input price.

Demonstration:BUY/SELL at Trading Stage 1

BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) 30.00 100 30.05 80 29.95 90 30.10 70 29.90 80 30.15 160 29.85 60 30.20 50 29.80 180 30.25 60

At stage 1, we can see that at price $30.05, there is 80,000 shares queued up already in the system. A client wishes to buy 450,000 shares at price $30.05, then by using Limit order, the client will have 80,000 shares executed, and 370,000 shares queue up in the system, shown as below at stage 2.After the match at Stage 2

BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) 30.05 370 30.10 70 30.00 100 30.15 160 29.95 90 30.20 50 29.90 80 30.25 60 29.85 60 30.30 300 - Clients can enter stock code, trading quantity and price during the Pre-opening session (Pre-opening Session: 9:00-9:30 am).

-

Special Limit Order

(i) Special Limit Order is only available on morning session (09:30am – 12:00pm). Special Limited Order is not applicable in Closing Auction Session. A special limit order will allow matching of up to 5 price queues (i.e. the best price queue and up to the 5th queue at 4 spreads away) at a time provided that the traded price is not worse than the input price. A special limit order has no restriction on the input price as long as the order input price is at or below the best bid price for a sell order or at or above the best ask price for a buy order.

(ii) Any outstanding special limit order will be cancelled and will not be stored in the AMS/3.Demonstration 1:

BUY/SELL at Trading Stage

BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) 30.00 100 30.05 80 29.95 90 30.10 70 29.90 80 30.15 160 29.85 60 30.20 50 29.80 180 30.25 60

By using special limit order, when client places a buy order for 450,000 shares at $30.15, the buy order will match with the sell order placed between $30.05 to $30.15 through the trading system and as a result, 310,000 shares are executed. Unlike enhanced limit order, the unexecuted order of 140,000 shares will be cancelled by the nature of special limit order.BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) 30.00 100 30.20 50 29.95 90 30.25 60 29.90 80 30.30 20 29.85 60 30.35 30 29.80 180 30.40 50 Demonstration 2:

BUY/SELL at Trading Stage

BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) 30.00 100 30.05 80 29.95 90 30.10 70 29.90 80 30.15 160 29.85 60 30.20 50 29.80 180 30.25 60

By using special limit order, when client places a buy order for 450,000 shares at $32, the buy order will match with the sell order placed between $30.05 to $30.25 (5 spreads) through the trading system and as a result, 420,000 shares are executed. Unlike enhanced limit order, the unexecuted order of 30,000 shares will be cancelled by the nature of special limit order.BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) 30.00 100 30.30 20 29.95 90 30.35 80 29.90 80 30.40 70 29.85 60 30.45 40 29.80 180 30.50 10 -

Can I place special limit order in Pre-Opening Session?

Yes, the order however will be set as pending and launched on continuous trading session at 9:30am.

-

Why are some orders rejected by system?

There are many reasons for orders to be rejected, including:

(a) buying power is not enough for purchasing amount;

(b) stock holding is not enough for settlement;

(c) required trading amount is not of a whole number of lot;

(d) purchase price of limit order set below 24 spreads away from market price;

(e) selling price of limit order set above 24 spreads away from market price;

(f) placing at-auction orders during continuous trading session;

(g) placing special limit order within closing auction session.

(h) At Auction Order, Limit Order, Special Limit Order are not applicable in Closing Auction Session.Further enquiry, please contact our customer service hotline (+852) 2250 8288 for more information.

-

What is Market Order?

Market Order helps customers to buy or sell securities at the prevailing market price and avoid missing investment opportunity caused by setting the Limit Price Order. Market Order is an order which client does not need to set a limit price and such order will be executed at the prevailing market price at time of execution. Yet customers should note that due to market fluctuation and technical factors, the executed price of Market Order may deviate from the market price at the point of time customer submits the Market Order, or a Market Order may not be fully / partially executed. Customer should from time to time check the execution status of Market Order from “Status” page.

Customers are allowed to input Market Order in Closing Auction Session, but order amendment is not permitted. They are only allowed to cancel Market Order before the “No Cancellation Period”. The order matching at the IEP calculated at the end of the “Random Closing Period” of the Closing Auction Session. -

Can I place MO before the pre-open session or after market close?

If MO is input on or before the pre-open session, or after market close, it would be rejected. If MO is input after pre-open session, it would be sent to market as SLO in continuous trading session.

-

Can I cancel or modify MO?

Market order can be cancelled if the order is pending in the system、registered as AO in HKEx、partial filled order or during the “Reference Price Fixing to Order Input” period,but not allowed to be cancelled during the “No Cancellation” and “Random Closing” Period (Unless the order is pending in the system and not transmitted to the HKEx).

Modification of MO is not supported by system under any circumstances. -

What is the limitation of MO?

Orders over 3000 lots is not supported.

-

What is the mechanism of MO?

The MO will be sent to market as SLO and repeat for 3 times. For Buy MO, SLO order price would be set as “Prevailing Best Ask + 14 spreads”. For Sell MO, SLO order price would be set as “Prevailing Best Bid - 14 spreads”. And if MO gets partially filled, the outstanding will be cancelled.

Illustration:

Place MO in Continuous Trading session

BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) 73.60 10 73.65 10 73.55 11 73.70 11 73.50 12 73.75 12 73.45 13 73.80 13 72.40 14 73.85 14 72.35 15 73.90 15 73.30 16 73.95 16 73.25 17 74.00 17 73.20 18 74.05 18 73.15 19 74.10 19 73.10 20 74.15 20 73.05 0 74.20 0 73.00 0 74.25 0 72.95 0 74.30 0 72.90 0 74.35 0 72.85 0 74.40 0 Scenario 1 – Buy MO 50K shares

1st SLO sent to market : 50K @ 74.35(73.65+14s) [current best ask:73.65] Fully filled 50K (10K@73.65, 11K@73.70, 12K@73.75, 13K@73.80, 4K@73.85) MO fully filled 50K and completed

Scenario 2 – Buy MO 100K shares

1st SLO sent to market : 100K @ 74.35(73.65+14s) [current best ask:73.65] Fully filled 100K 10K@73.65, 11K@73.70, 12K@73.75, 13K@73.80, 14K@73.85, 15K@73.90, 16K@73.95, 9K@74.00) MO fully filled 100K and completed

Scenario 3 – Buy MO 200K shares

1st SLO sent to market : 200K @ 74.35(73.65+14s) [current best ask:73.65] Partially filled 145 (10K@73.65, 11K@73.70, 12K@73.75, 13K@73.80, 14K@73.85, 15K@73.90, 16K@73.95, 17K@74.00, 18K@74.05, 19K@74.10) 2nd SLO sent to market : 55K @ 74.35 Partially filled 20K and o/s rejected by HKEx (20K@74.15) MO filled 165K, o/s cancelled and completed

-

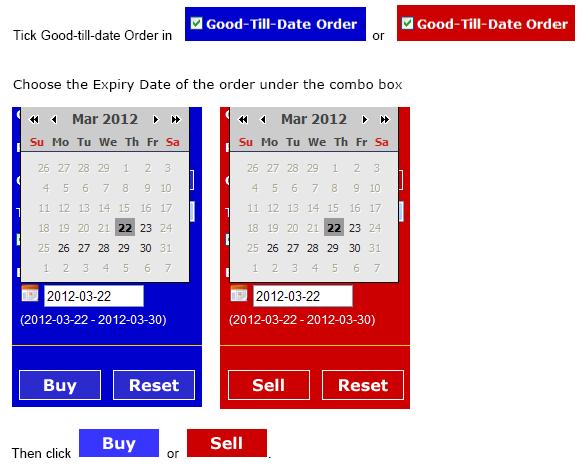

What is Good-Till-Date (GTD) Order?

Good-Till-Date (GTD) order is limit order to buy or sell products until the specified expiry date.

-

How to place a GTD order?

-

What is the price restriction on new GTD order?

New GTD order with order price 10 spreads worse than nominal will be rejected.

-

How to check order history?

In status:

HLD – If the price of GTD order is out of 24 spreads from the market price, the order would be held in our system as HLD (hold) status.

REG – When the market price moves such that the GTD order reaches within 24 spreads of the market price, the order would be sent to market and become registered (REG), until it is Partial Filled (PFL) or Fully Filled (FFL).

Expiry Date – Expiry date of the GTD orders would be shown. -

What if the order is not fully filled?

If the GTD order is not fully filled or successfully cancelled by client on the order input date, the outstanding quantity would be brought forward to the next trading day and sent to market at 9:00am until the order is cleared up at the market close of the expiry date. If the GTD order is fully filled or successfully cancelled by client before the expiry date, it will not be retained in the system nor brought forward to the next trading day anymore.

Please note that the carried forward GTD order has the following price restrictions:- Buy order price below 1/9 of nominal, or sell order price 9-times above the nominal will be rejected.

- Buy order price above 1/9 of nominal and 80 spreads below nominal, or sell order price below 9-times of nominal and 80 spreads above nominal will not be sent out at 9:00am but to be kept in the system as HLD status.

- Buy order price below 1/9 of nominal, or sell order price 9-times above the nominal will be rejected.

-

What is the order type of GTD?

Only limit order supports GTD.

-

When will system sends the GTD order to the market?

Buy order would be sent to market when best bid reaches +24 spreads from order price. Sell order would be sent to market when best ask reaches -24 spreads from order price.

-

Can I cancel or modify the order?

GTD order cannot be modified, but it can be cancelled during 7:00am to 4:10pm of a Hong Kong business day.

-

How long is the validity period for a GTD order?

The maximum validity period is 15 trading days.

-

Will I be informed for any corporate action?

System would not cater for any stock price adjustment due to Corporate Actions, etc. and thus would not cancel any GTD orders automatically. Customers need to check the related information and make proper arrangement on their GTD orders by themselves.

-

Can I input GTD order when the stock suspends?

GTD order input before stock suspension would be kept hold until order expiry or sent to market when it becomes active, while GTD order input after stock suspension would be rejected directly.

-

Is there any notification before the expiry date when the order is not completed?

No. There will not be any notification near the expiry date.

Illustration:

Place GTD in Continuous Trading session

BUY SELL PRICE($) QUANTITY(000) PRICE($) QUANTITY(000) 73.60 10 73.65 10 73.55 11 73.70 11 73.50 12 73.75 12 73.45 13 73.80 13 72.40 14 73.85 14 72.35 15 73.90 15 73.30 16 73.95 16 73.25 17 74.00 17 73.20 18 74.05 18 73.15 19 74.10 19 73.10 20 74.15 20 73.05 0 74.20 0 73.00 0 74.25 0 72.95 0 74.30 0 72.90 0 74.35 0 72.85 0 74.40 0 Scenario 1 – Buy 100K @ $74.20 on 2010-12-23, expire on 2010-12-28

2010-12-23 GTD order sent to market : 100K @ $74.20 Order status = REJ and complete

Rejected by market with “Invalid order price”

Scenario 2 – Buy 100K @ $70 on 2010-12-23, expire on 2010-12-282010-12-23 GTD order sent to market : 100K @ $70 Order status = HLD and wait for best bid to become $71.2(70+24s)

Best bid does not drop to $71.2 till market close, o/s qty is carried forward in dayend to 2010-12-24 with qty 100K @ $70 as HLD2010-12-24 Best bid drops to $71.2 GTD order to market : 100K @ $70

Registered in market

No more executions till market close, 10K @ $70 is concluded as a trade of 2010-12-24, o/s qty of 90K @ $70 is carried forward in dayend to 2010-12-28 as HLD2010-12-28 Best bid is $70 GTD order sent to market : 90K @ $70

Partially filled 20K @ $70

No more executions till market close, 20K @ $70 is concluded as a trade of 2010-12-28, o/s qty is cleaned up in dayend due to order expiry -

Can I input GTD order to Closing Auction Session?

Yes, allow to input and cancel GTD order in Closing Auction Session and After Order Matching Period, but order amendment is not permitted. If the GTD order is not fully filled or successfully cancelled by client on the order input date, the outstanding quantity will be carried forward to next trading day and sent to market at 9:00am until the order is expired.

-

What is Closing Auction Session?

Full Day Trading Half Day Trading* Reference Price Fixing Period 16:00-16:01 12:00-12:01 Order Input Period 16:01-16:06 12:01-12:06 No Cancellation Period 16:06-16:08 12:06-12:08 Random Closing Period 16:08-16:10 12:08-12:10 *Eves of Christmas, New Year and Lunar New Year

-

What is Closing Auction Session Model?

Reference Price Fixing Period (Full Day Trading 16:00-16:01 / Half Day Trading 12:00-12:01)

In the first period, a reference price, which sets the allowable price limit of the CAS (±5 per cent from the reference price), is calculated for each CAS security. The reference price is determined by taking the median of 5 nominal prices in the last minute of the Continuous Trading Session (CTS) and the system will take 5 snapshots on the nominal prices at 15-second interval starting from 15:59:00.

After determination of reference prices, the system will disseminate the reference prices and price limits to the market. Orders outstanding at the end of the preceding CTS will be automatically carried forward to the CAS and treated as at-auction limit orders except that the system will cancel those aggressive orders with prices outside the permissible price limit (i.e. buy orders with prices higher than the upper price limit and sell orders with prices lower than the lower limit).

For non CAS securities, reference prices are also determined in the same way as CAS securities and such prices will be disseminated to market for information as the reference price will be same as the closing price of the respective non CAS security. However, orders cannot be entered and executed on non CAS securities during the CAS.

All order messaging from Exchange Participants, including new input, amendment and cancellation will be rejected by AMS/3 system during the Reference Price Fixing Period.Order Input Period (Full Day Period 16:01-16:06 / Half Day Period 12:01-12:06)

In the second period, at-auction orders and at-auction limit orders within the ±5 per cent price limit can be entered on CAS securities. Outstanding orders can also be amended or cancelled during this period.No Cancellation Period (Full Day Period 16:06-16:08 / Half Day Period 12:06-12:08)

Starting from the third period, at-auction orders and at-auction limit orders can be entered. However, the prices of new at-auction limit orders must be between the lowest ask & highest bid recorded at the end of Order Input Period (i.e. recorded at 16:06), and no orders can be amended or cancelled.Random Closing Period (Full Day Period 16:08-16:10 / Half Day Period 12:08-12:10)

In the last period, the order rules from the No Cancellation period apply and the market closes randomly within two minutes.Order Matching (After Random Closing Period)

After the random closing period, orders for all CAS securities are matched at the final IEP. In cases where final IEP cannot be established during the CAS, the reference price will be treated as the final IEP for order matching and will become the closing price of the CAS security. Order matching is based on order type, price and then time priority. -

Which type of order can be place during Closing Auction Session?

Market Order

Good-Till Day Order

CAS-AO

CAS-ALO -

CAS-AO and CAS-ALO can be used via all trading system?

No, CAS-AO and CAS-ALO is not available for Qian Long and Mobile platform until further notice.

-

What is Closing Auction Session Indicative Equilibrium Price (The Closing Price)?

The IEP calculated at the end of the “Random Closing Period” of the Closing Session within the highest bid and the lowest ask and at which the aggregate volume of matchable orders is maximized. It is continuously calculated during the Closing Auction Session. Please read Hong Kong Exchange website for relate Indicative Equilibrium Price detail.

-

What should I do if I want to trade listed Renminbi denominated securities (“RMB securities”)?

If you are our existing client, you can direct your request to your account executive; otherwise please visit our branch in person for securities account opening. You can place the order only provided that there is a corresponding amount of RMB deposited in your account.

-

Why do I invest in RMB securities?

The fact that such securities are settled in RMB implies potential capital gain when stock price increases, which comes with a further profit resulting from a more favourable exchange rate if RMB appreciates.

-

What are the risks in investing in RMB denominated securities?

Investment / market risk: Like any form of investment, RMB securities are subject to investment risk and are generally not principal protected i.e. the security itself, or underlying assets that the securities are composed of/referenced to are exposed to price fluctuation, resulting in gains or losses in the value of the securities. This implies that you may suffer a loss even if RMB appreciates.

Liquidity risk: As a new type of product, RMB securities are also subject to liquidity risk. There may not be regular trading or an active secondary market for certain types of RMB securities. Consequently, you may not be able to sell your investment in a security on a timely basis, or you may have to sell it at a deep discount to its value.

Currency risk: An investor is also subject to the downside risk of RMB depreciation if he/she intends to convert any RMB-denominated redemption / sale proceeds into another currency.Depending on the nature of the security and its investment objective, there may be other risk factors specific to the product which you should consider. Before making an investment decision, please seek professional advice where necessary.

-

If I do not have sufficient RMB for trading, but I have other types of currency (e.g. Hong Kong Dollars) in my securities account maintained with Shenwan Hongyuan, can I still trade in RMB securities?

As we can only execute your RMB buying order provided that there is sufficient fund in your account; you have to contact your account executive to arrange for an exchange instruction into RMB from another currency before placing an order in RMB.

-

Can I use the proceeds (in HKD) from selling Hong Kong securities to fund my purchase of RMB securities in the same day?

Given that your selling order on the Hong Kong securities is completed, you may contact your account executive to exchange those proceeds from HKD to RMB in order to fund your RMB purchase thereafter.

-

Can I trade and check price quotes of RMB securities on the Shenwan Hongyuan online trading system?

Yes, you can.

-

Can I trade RMB securities on Hong Kong public holidays?

Since the RMB securities are being traded in the Hong Kong Stock Exchange, the market is closed on Hong Kong public holidays.

-

How do I deposit RMB into my securities account?

You can deposit RMB via our Standard Chartered Bank and Bank of China bank accounts. You must write down your name, account number and sign on the deposit slip and fax the slip to us for confirmation. Please note that the cut off time for RMB deposit is 3:00pm on Monday to Friday (excluding public holidays).

-

How do I check my account balance and transaction records?

You can check your account details by logging in to our online trading system, contacting your account executive or by viewing your daily/monthly account statements.

-

If I want to exchange the HKD in my securities account into RMB for trading RMB securities, which exchange rate will Shenwan Hongyuan refer to, and is there any maximum daily limit on such an exchange?

We refer to the RMB-HKD exchange rate offered by major banks in Hong Kong. We do not have any daily limit on the exchange to RMB in normal circumstances.

-

Can I withdraw RMB after selling RMB securities?

Yes, you may withdraw RMB from your securities account. However, if your personal bank account is denominated in another currency (e.g. HKD), the receiving bank may automatically convert the RMB into that currency upon deposit. Therefore, you may wish to arrange for a RMB bank account in advance.

-

What is the commission rate for trading RMB securities? Are there any other charges?

Existing clients are charged the same commission rate for trading RMB securities as trading HKD securities. For new clients, our default commission rate is 0.25% to 0.5% of the transaction amount and subject to minimum charge of RMB100. Apart from the commission rate, the trading fees include: Stamp Duty (0.1% of transaction amount, rounded up to the nearest dollar), Transaction Levy (0.003% of transaction amount), Trading Fee (0.005% of transaction amount), CCASS Fee (0.002% of transaction amount).

Please note: Stamp Duty (in RMB) is quoted in HKD using the CCASS reference exchange rate. We will use the same exchange rate to calculate the amount of Stamp Duty in RMB that we will deduct from your account.

For example: Buy 10,000 shares RMB securities at $1/share, CCASS reference exchange rate is 1.171 (HKD/RMB)

Transaction Amount: RMB 10,000.00 Stamp Duty: RMB 10,000.00 convert to HKD $11,710.00

Total Stamp Duty is HKD $12.00Stamp Duty Payable: RMB 10.25 (Converting HKD $12.00 into RMB) -

Do I need to pay any charges and fees on withdrawal of RMB from my account?

You can withdraw RMB by requesting us to issue a cheque or by telegraphic transfer to your bank account, which we will charge a handling fee on T/T as detailed in the Fees Table.

-

Can I remit RMB to Mainland China?

No, you cannot remit RMB to Mainland China.

-

What are the risks involved for trading RMB denominated products?

Please refer to the “Risk Disclosure Statement for Trading Renminbi Products” by clicking into the “Download Forms” posted under the “Customer Service” section of our website for details.

Account Opening:

-

If I have a securities account in SWHY, then do I still need to apply for an additional account for stock option trading?

Existing clients can apply for the service by visiting our branches or mailing the application to our support centre or account executive. If you wish to apply for the service by mail, you may download and complete the Stock Option Service Application from our website www.swhyhk.com. After we have received your mailing application, our account executive will contact you to explain the risks and disclaimer with client verbally by phone.

-

If I own a joint name securities account in SWHY, do I need to open the stock option account under joint name as well?

Yes, you must open the stock option joint name account.

-

Can I have a third party authorized person in the stock option account that is different from my securities account?

No, the third party authorized person must be the same in the stock option account and the securities account.

Trading:

-

What is the difference between a Futures Contract and an Option Contract?

A futures contract is a legally binding commitment between two parties to buy or sell a specific financial instrument at a given future date at a price set at the time of dealing. And stock option is a contract entered between the contracting parties, a buyer and a seller. The buyer has the right, but not the obligation, to trade an underlying asset with the seller at a predetermined price, within a certain time.

-

What is the option premium?

The cost of an option or the price at which an option is traded is the option premium. The price of stock options traded on SEHK is quoted on a per share basis. It is the seller who receives the option premium.

-

Can I trade stock options of all stocks listed on HKEx?

No. Stock option trading includes certain listed stocks only. For details, please refer to our option class list.

-

Do I need to deposit sufficient fund of premium/ initial margin in my stock option account before trading?

If the client has sufficient amount in his/her securities account, he/she can transfer the fund after trading. Otherwise, client must deposit sufficient fund before trading.

-

When do I need to pay for the initial margin?

Client is required to deposit initial margin when trading short call or short put option contracts. Client must maintain sufficient margin so that the client can fulfill his/her obligation to option buyer when the market fluctuates. When the market is in fluctuation, client may be required to deposit additional margin by Intra-day Margin Call. For details, please refer to our margin class table and option statement.

-

What should I do if I want to trade covered call?

You should notify your account executive that the option contact is under covered call when placing the order. We will then transfer the captioned stocks from your securities account to your stock option account.

-

Does stock option has At-auction period?

No, stock option does not have at-auction period.

Exercising Option:

-

How can I exercise the option?

You have to complete our option exercise instruction form and return it before 4:30pm on the expiry day.

-

What should I do if my Long Put / Short Call option has been exercised?

Your account must have sufficient stock for settlement before the settlement date (T+2); otherwise, you have to purchase the stock at or before 3:00p.m. on T+1 to ensure your account has sufficient stock for settlement.

-

What should I do if my account doesn’t have sufficient fund to purchase the stock after the Long Put / Short Call option has been exercised?

You have to deposit sufficient funds into your stock option account as soon as possible. Otherwise, we are obligated to charge you debit interests on the outstanding amount.

-

What are the charges and fees for purchasing the stock for option settlement by SWHY?

We will charge you the securities trading brokerage commission.

-

Can I cancel or change my instruction after exercising the option?

As exercising instruction cannot be cancelled or changed, client must understand the risks and charges before placing the instruction.

-

What should I do if I do not want to exercise my in-the-money option on the expiry day?

You must contact us by phone to cancel the action of exercise automatically before 4:30p.m. on the expiry day.

-

If my short call option has been exercised before the ex-dividend date but I purchase the stock after the ex-dividend, then do I need to pay back the dividend to the buyer?

Yes, you are required to pay back the dividend to buyer under this situation. The amount of dividend will be debited from your securities account.

Others:

-

Where can I find notifications or news about stock options?

For details, please browse HKEx website.

-

What is Capital Adjustments? How does the capital adjustment affect the stock options value?

Adjustments to the share price are a common phenomenon arising naturally in the market when a company announces a share sub-division or a share consolidation or makes changes to its capital structure by way of rights issues, bonus issues, cash dividend payments etc. This adjustment occurs naturally in the market place as soon as the share trades ex-entitlement or the corporate action takes effect.

As stock options are derivatives products of the equity securities, the effects on the stocks market price will directly impact on the options value. -

Does the Capital Adjustment affect covered call options?

Yes, as the number of shares per contract will be affected by capital adjustment; therefore, the covered call will be “De-covered” automatically after the capital adjustment, and the client is required to deposit initial margin for the Short Call contracts. If the client still wants to cover the short call contract, he/she may need to purchase the stock to a sufficient amount for settlement.

-

Which one should I choose if there are 2 different stock options in the market after the capital adjustment?

Please refer to the option class list for the updated HKATS code as the turnover is higher for these option contracts.

-

Will the options be affected if the equity securities are suspended for trading?

The related options will be suspended for trading if the equity securities are suspended for trading. However, if the equity securities are still suspended for trading on the option expiry day, the latest market price before suspension will be used accordingly. If the option contract is in-the-money for or above 1.5%, the in-the-money option will be exercised automatically. If the seller does not have sufficient shares for settlement, the buy back action will be performed after the equity securities resumes trading.

-

What is Random Assignment?

After market close on the last trading day of a Physical Delivery Contract, the Clearing House will allocate all short positions in such Contract to long positions in such Contract by a random assignment process. All long positions and short positions will be arrayed in two respective columns. Under the random assignment process, a random number will be generated to determine the short position (“starting short position”) that is to be allocated to the first long position. Each consecutive short position following the starting short position will then be allocated to each consecutive long position following the first long position and the short positions listed above the starting short position will be allocated to the remaining long positions under the long position column. After HKEx’s random assignment process, SWHY will allocate the short position with the long positions in secondary random assignment process.

-

What is the role of Liquidity Providers?

Issuers are required to appoint Liquidity Providers (LPs) to provide liquidity for their listed structured products. For each structured product issue there can only be one LP. Market participants can visit Hong Kong Exchanges and Clearing Limited (HKEx)'s website for the list of LPs. In normal circumstances, LPs should provide liquidity for structured product issues by means of continuous quotes or quote request from five minutes after the market has opened until the market closes. Under the quote request system, LPs would provide bid/ask prices only upon receiving quote requests. A telephone number that investors can call for quote requests via their brokers is displayed on the structured products' stock page and in the listing document.

-

What is the settlement price of the equity securities on the date of settlement of stock options?

The settlement price refers to the equity securities price at market close.

Account Opening:

-

How to apply for the stock borrowing service?

If you are our existing client, you may need to complete the Securities Borrowing and Lending Agreement and appendix documents. Please contact your account executive for application of the service.

If you are a new customer, then you can apply for the service during your account opening application. -

Does SWHY accept online application for the stock borrowing service?

We do not accept online application. You can only apply for it by contacting your account executive.

-

Can a third party authorized person for the stock borrowing different from my securities account?

No, the third party authorized person must be the same in stock borrowing and the securities account.

Trading:

-

Can I conduct short selling of all stocks listed on HKEx through the Stock Borrowing service?

At present, the constituents of Hang Seng Index and Hang Seng H Share Index are only available for short selling in our stock borrowing service. For details, please contact your Account Executive or customer hotline (852) 2250 8298.

-

Do I need to pay fees or interest during the borrowing period?

Besides the trading related charges and fees, interests will be charged on the last trading date of each month once the stock borrowing arrangement becomes effective.

-

Do I need to deposit sufficient fund for the initial margin in my account before the stock borrowing arrangement?

The client must maintain sufficient fund for initial margin before the stock borrowing arrangement.

-

When do I need to pay the maintenance margin?

Client must maintain sufficient margin so that the client can fulfill his/her obligation to buy back the short selling stock when the market fluctuates. When the market is in fluctuation, client may be required to deposit additional margin by Intra-day Margin Call.

-

Do I entitle to receive the dividend if I borrowed the stock before the ex-dividends date?

As the dividend belongs to the beneficiary, the lender of the stock, you are not entitled to receive any dividend of the borrowed stock. If you have borrowed the stock and sold before the ex-dividend date, then you must repay full amount to the lender the dividend.

-

What I should do if I want to repay the owed stock after buying back?

You can notify your Account Executive for arrangement. Please be reminded that the stock will not be automatically repaid for buying back before the proper procedure is completed.

-

Can I refuse to return the stock after receiving the stock return request?

You cannot refuse to return the owed stock after receiving the request. You must buy back or borrow the stock from a third party to return the stock to lender.

-

What are the charges and fees for purchasing the stock for stock call back by SWHY?

We will charge you the securities trading brokerage commission.

-

What should I do if the call back stock is suspended in HKEx?

You have to buy back the stock once the stock is released from suspension.

-

Can I repay the owed stock partially?

Yes, interest will only be charged on the number of the stock still borrowing.

-

Can I sell the borrowed stock via SWHY online trading?

Yes, the borrowed stock will deposit into your trading account, so you can place your selling instruction via online trading or through account executive.

-

How can investors distinguish between the RMB counter and HKD counter of a Dual Counter RQFII ETF? Will there be any identification in their stock codes and stock short names?

Customer can distinguish between the two trading counters of a Dual Counter ETF by their stock codes and their stock short names.

Separate and unique stock codes will be assigned to the HKD and RMB counters respectively. The last four digits of the stock codes for the two counters will be the same, while the stock code for RMB counter will be a 5-digit number starting with an “8”, in line with the existing allocation arrangement.

/- HKD counter /- XXXX

/- RMB counter /- 8XXXX

The stock short names for the two counters will also be different. For the RMB counter, the stock short name will end with -R to indicate that the ETF is traded in RMB. There will be no specific marking in the stock short name of the HKD counter.

The following is an illustrative example of the stock short names:

/- HKD counter /– "XYZ ETF"

/- RMB counter /– "XYZ ETF-R" -

Will it becomes short selling if I buy the units in one counter followed by selling the units in the other counter within the same trading day?

No, you are buying and selling the same ETF unit, it is same practice of day trade.

-

Would it be permissible if I buy the units in one counter followed by selling the units in the other counter within the same trading day?

Yes, this would be permissible under the existing rules. However, in order to meet the settlement obligation, you must place the instruction to Account Executive for transferring the units from one counter to the other on or before T+1 for timely settlement of transactions on T+2 basis.

-

What is the cost of effecting a "Multi-counter Transfer Instruction" in CCASS?

HKSCC will charge HKD5 for each effected Multi-counter Transfer Instruction.

-

Can I buy the units in one counter followed by the selling of the units in the other counter within the same trading day via online trading service?

No, you can only place order with your account executive by buying and selling in different counter.

For detail, please refer to Point to note

-

Do I need to apply Online FX Service?

All SWHY clients can use Online FX Service without application.

-

Do I need to pay handling charge on using online FX Service?

There is no handling charge on using Online FX Service.

-

Where can I do the currency exchange?

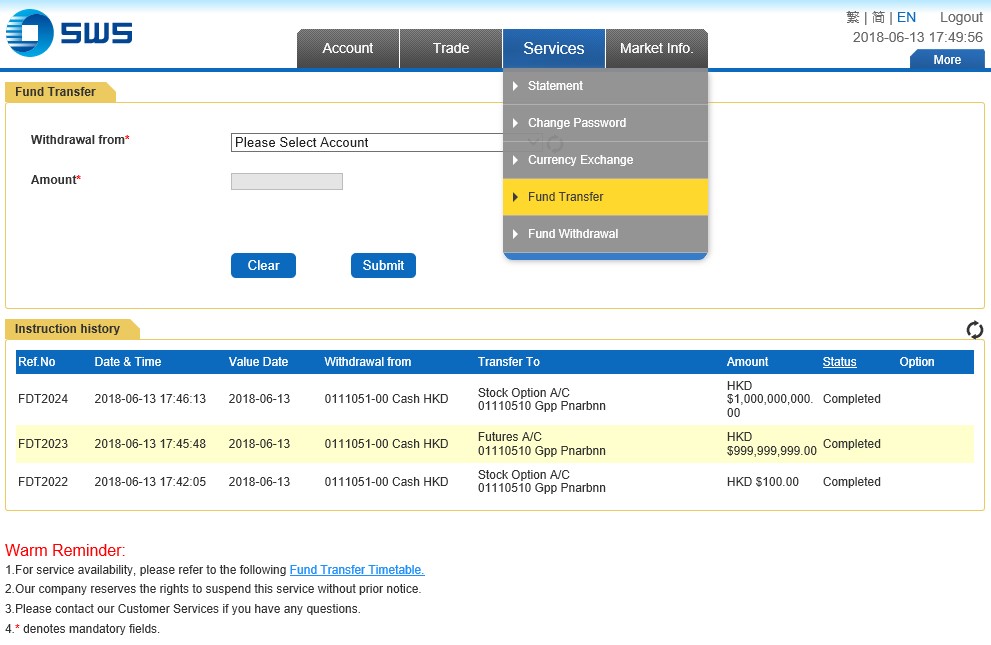

Please log in the「Consolidated e-service」, choose “Services” and then “Currency Exchange”.

-

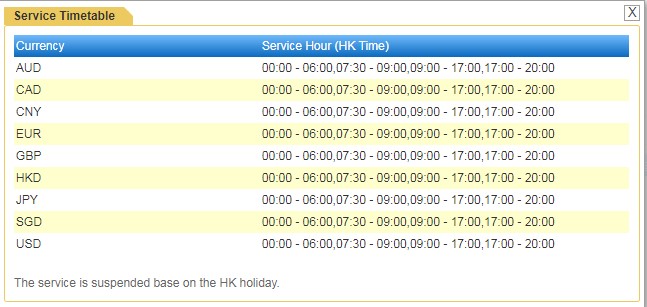

What is the service hour?

The service hour is 9:30 - 14:00 (HKT), except Hong Kong holidays. Please also note that our company reserves the rights to suspend this service without prior notice.

-

Which currencies can I exchange on Online FX Service?

For now, Online FX is available to support the exchange among 3 currencies: HKD, CNY and USD. At the same time, we are pursuing access to other currencies online exchange for our valued clients and will update related modules in the future. If you need to exchange currencies other than the above mentioned 3 pairs, please contact with Account Executive.

-

Is there any transaction limit of Online FX Service?

Yes, there is a transaction limit depends on the market situation every day. If you have any problem during your exchange online such as exceeding limit, please contact our Account Executive without hesitation.

-

Can I cancel or amend my exchange instructions after completing it?

Sorry. The instruction is effective immediately after submission and cannot be cancelled or amended.

-

What are the advantages by using Online FX Service?

Due to the real time adjustment of foreign exchange rate, Online FX Service can catch up the market changes easier and save your time. Besides, it can also help you do trading immediately once you have completed FX transaction online.

For detail, please refer to Average Cost Computation Service – FAQ

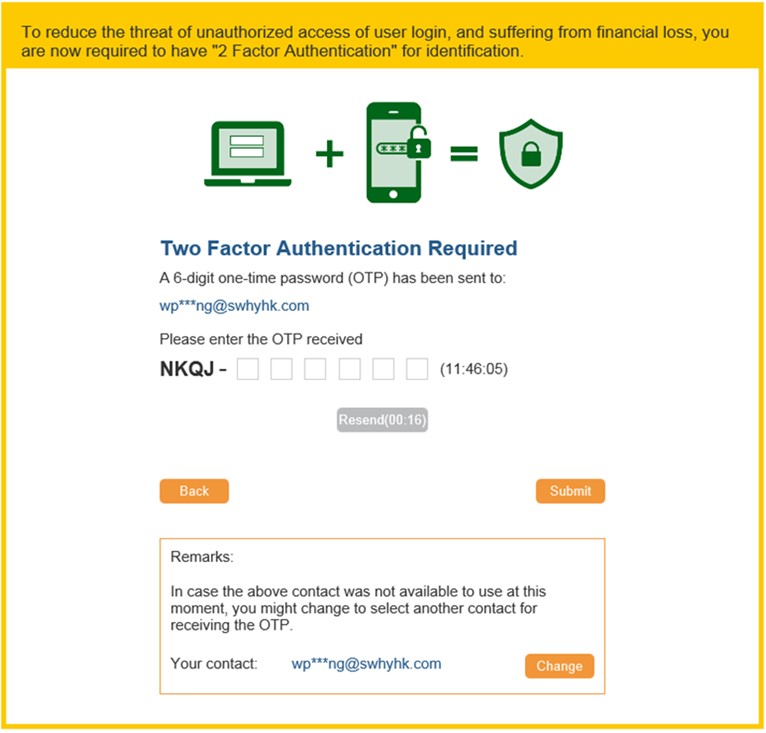

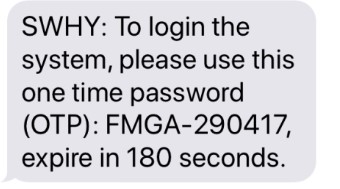

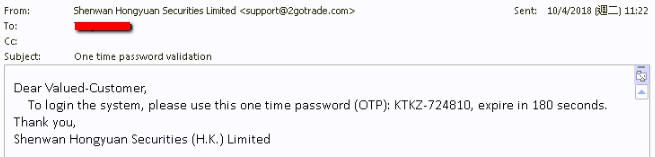

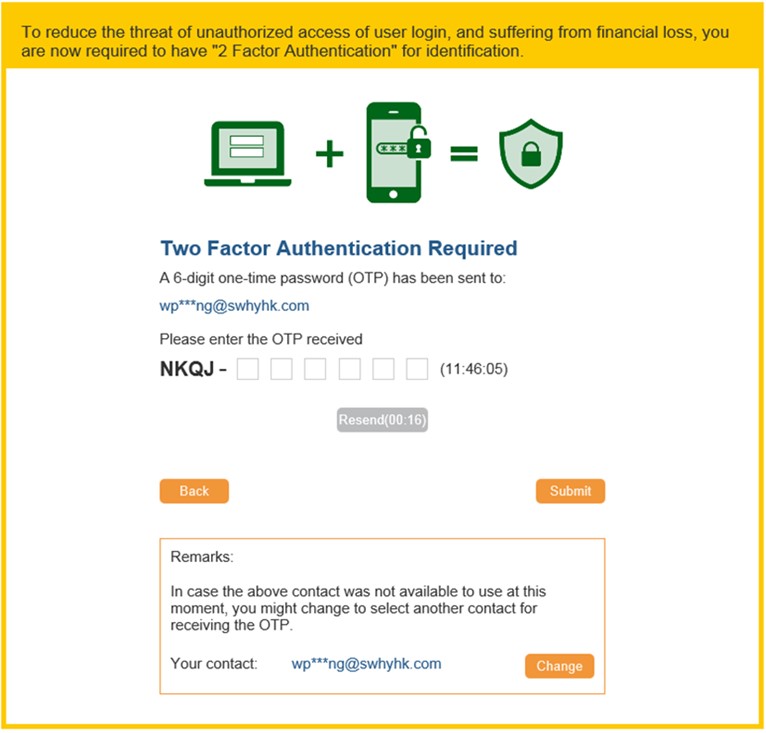

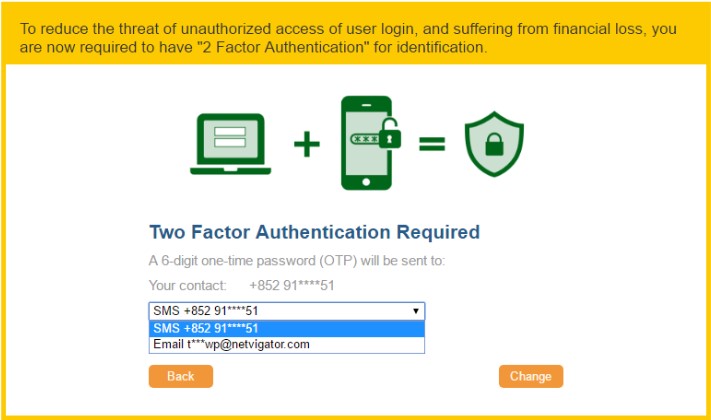

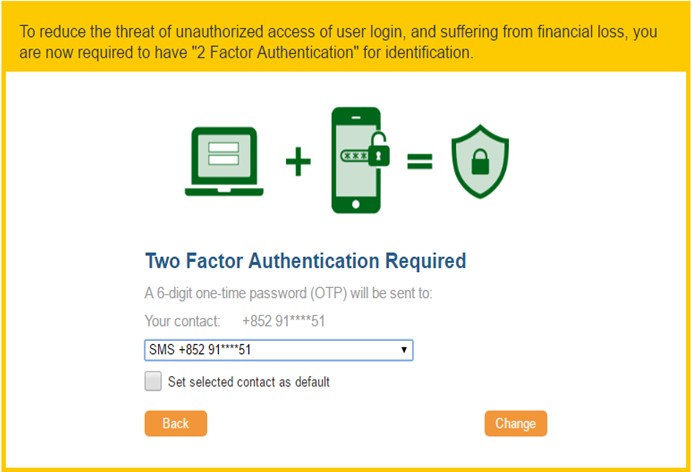

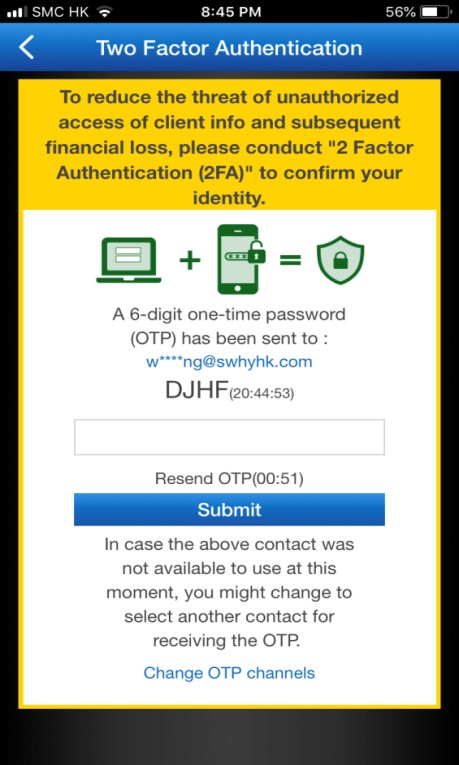

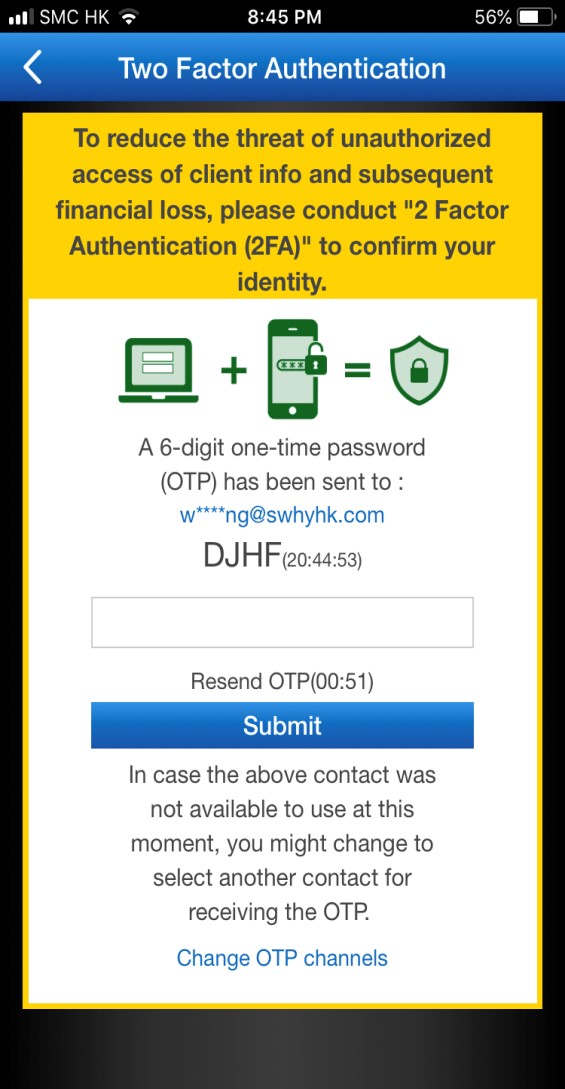

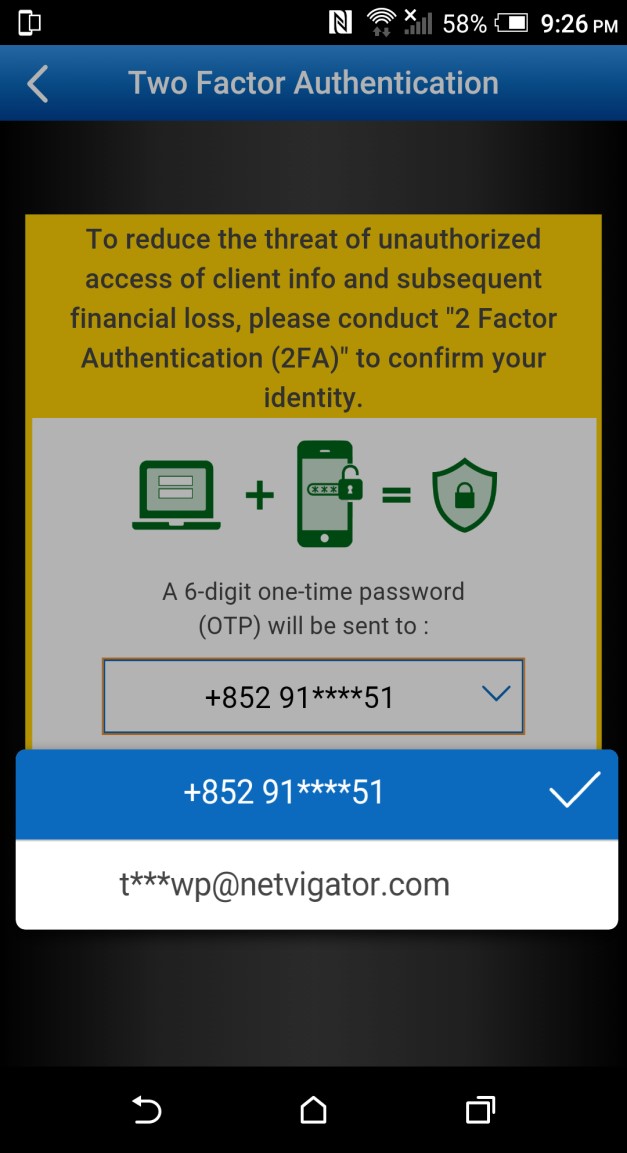

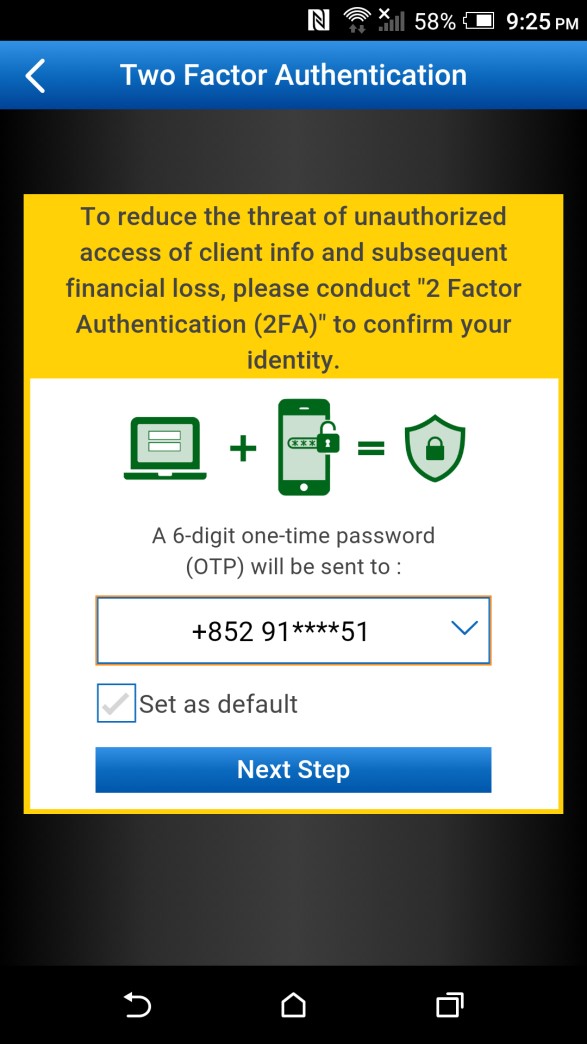

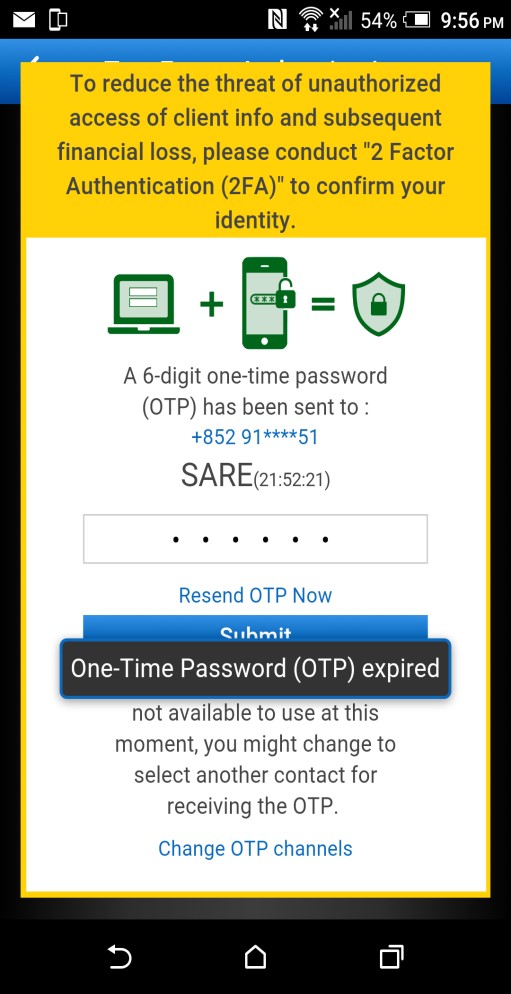

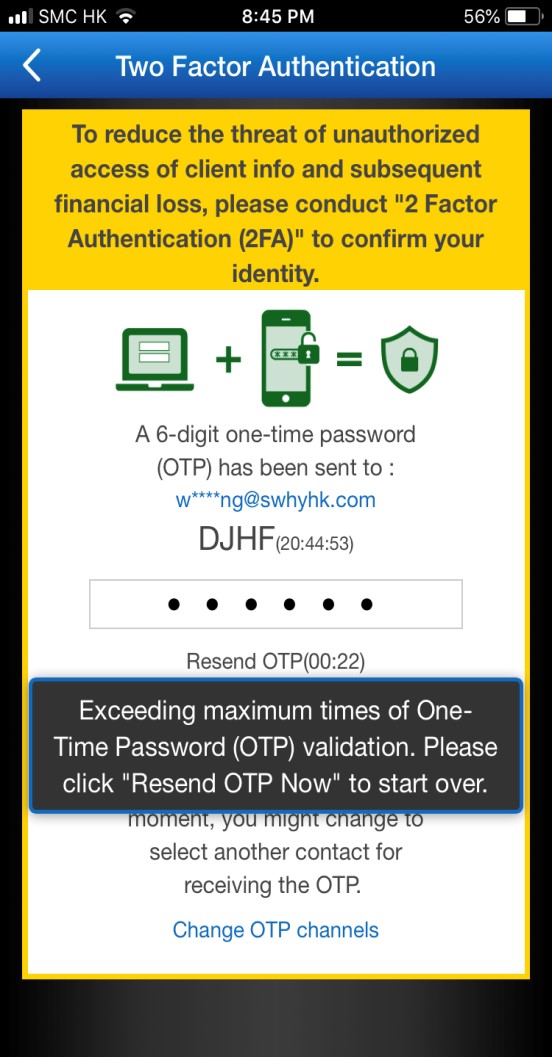

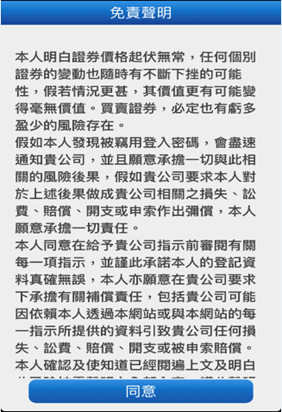

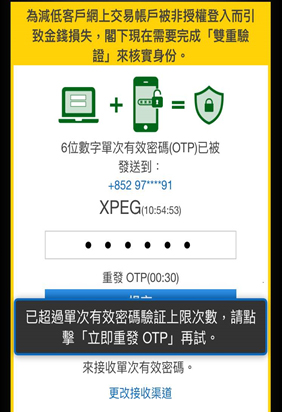

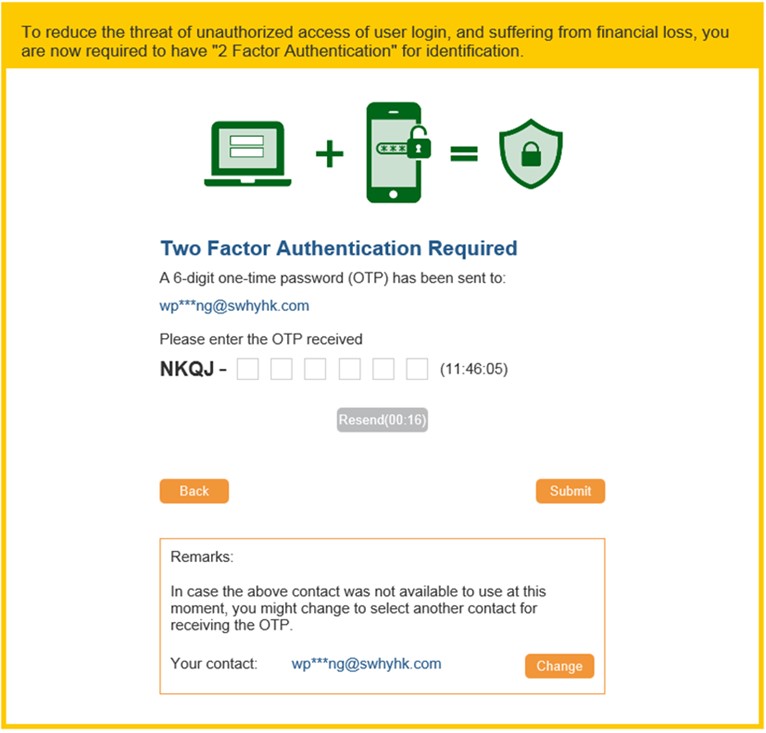

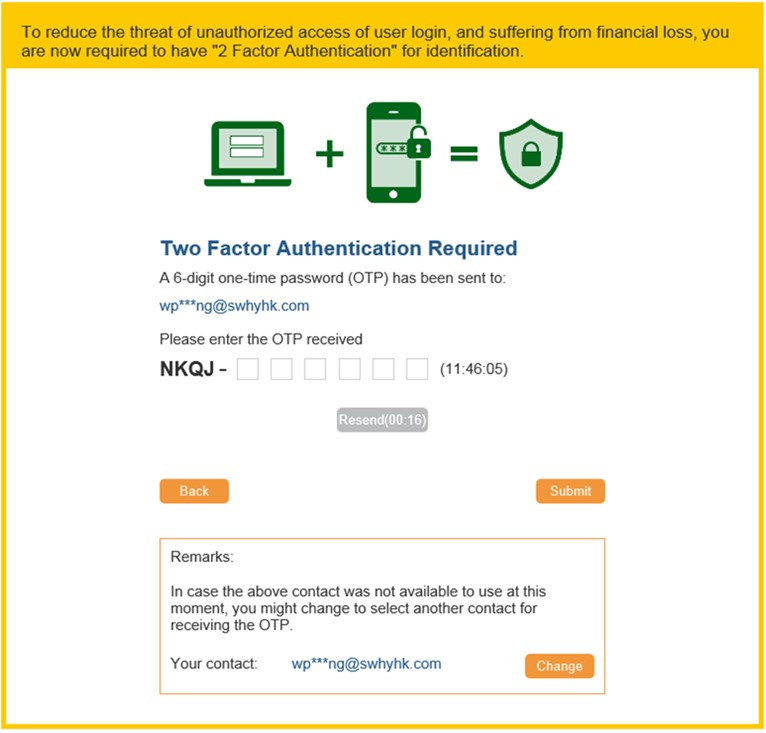

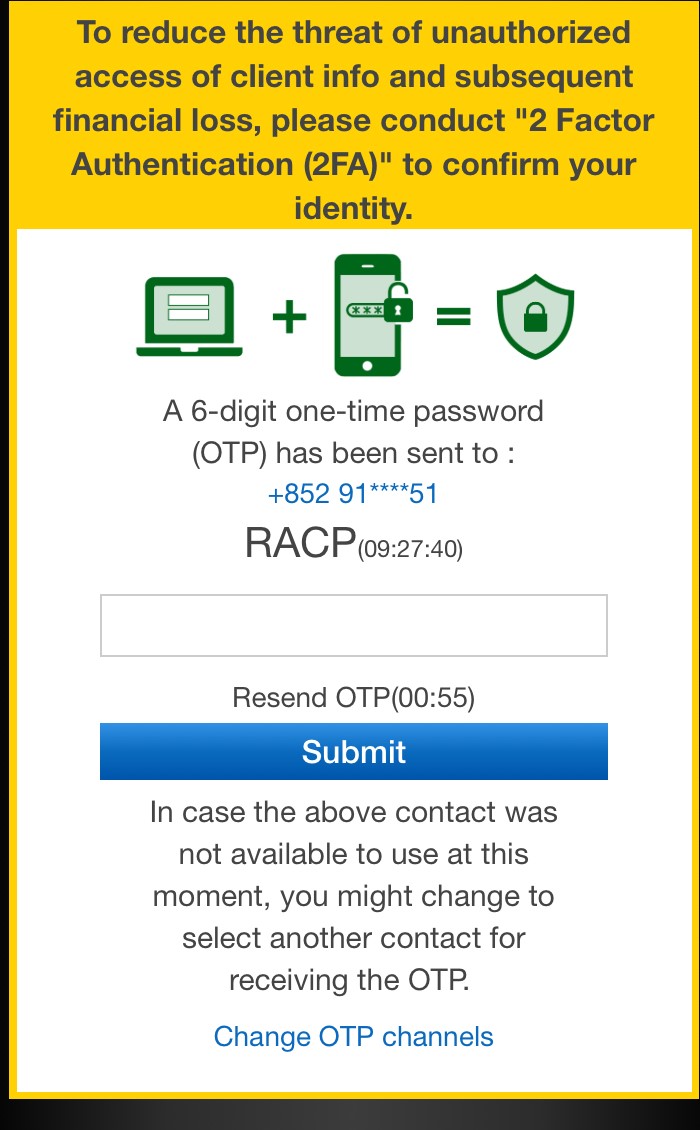

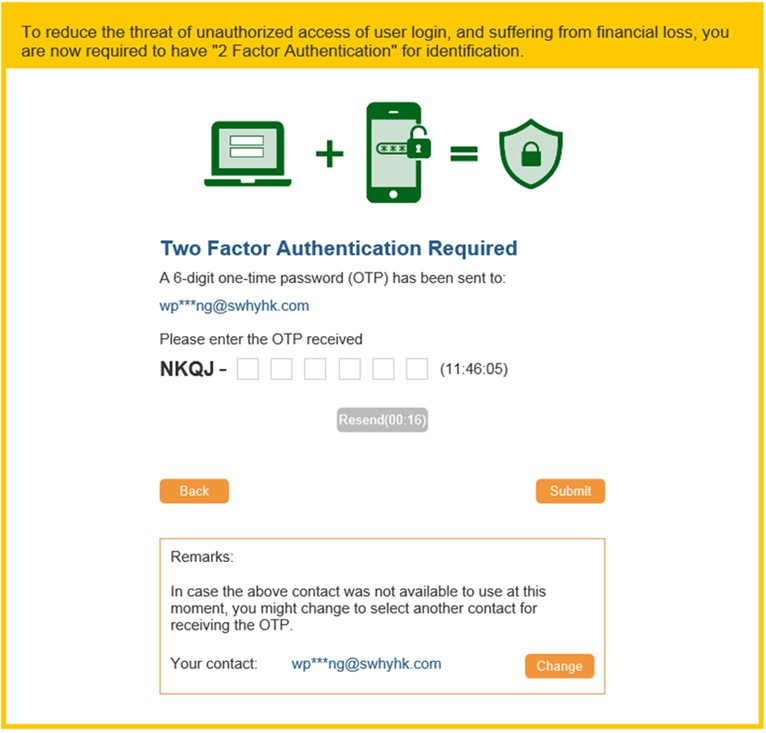

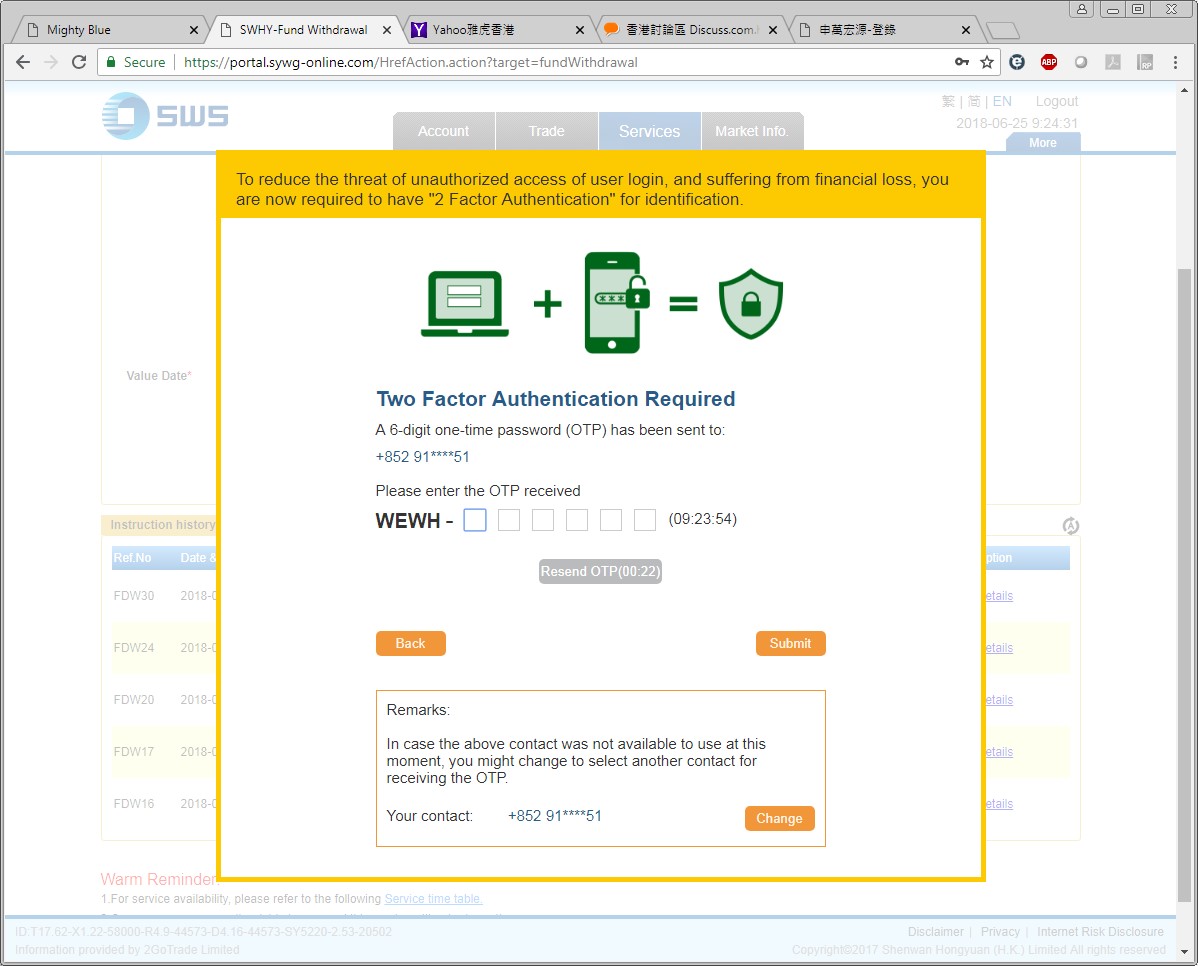

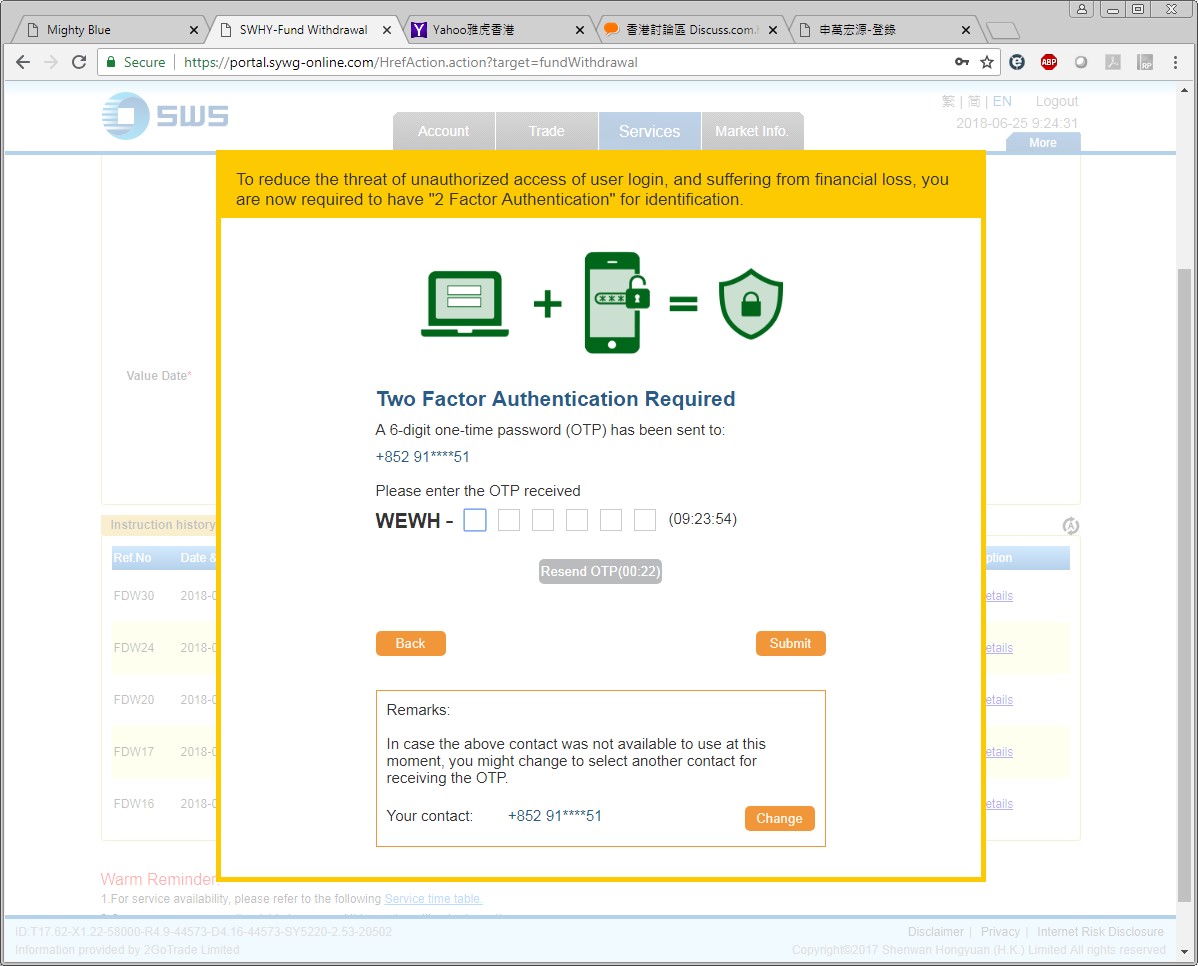

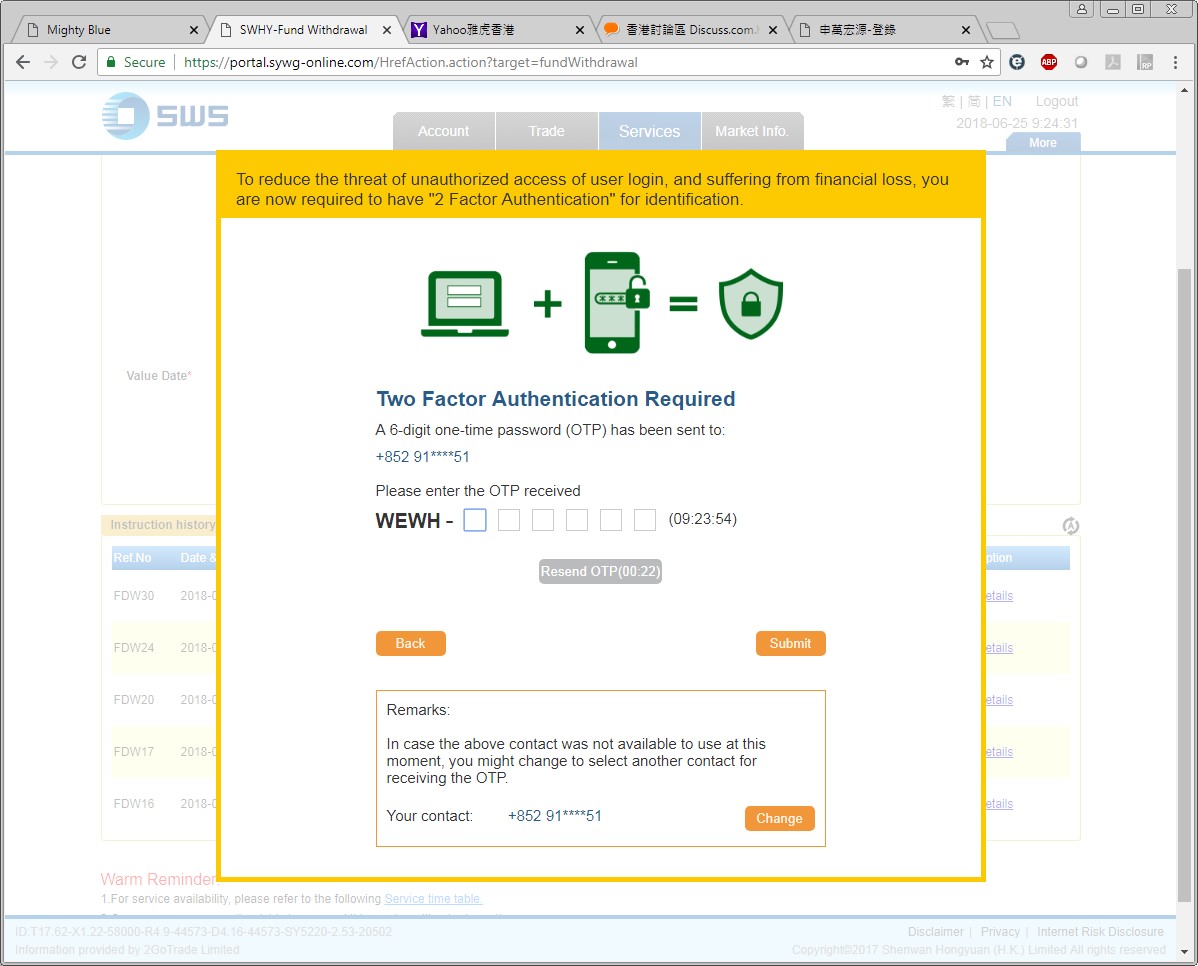

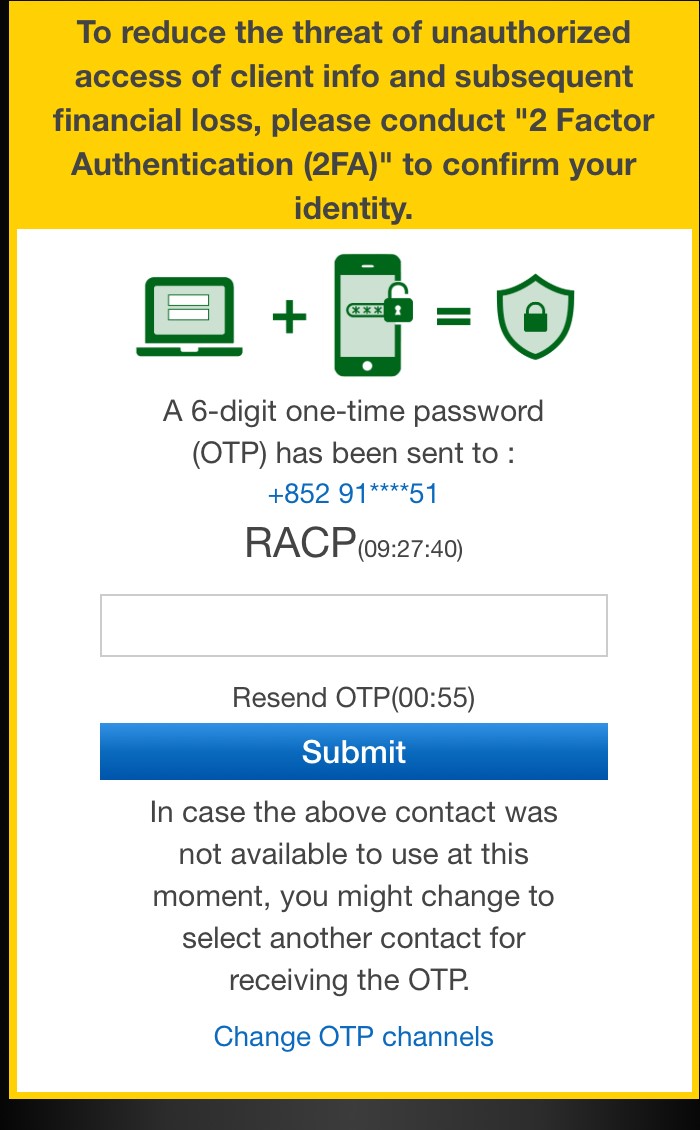

Notice: Two-Factor Authentication is supported by Mobile App version 2.5.1 or above only.